Engineering disciplines have repeatedly discovered "missing" fundamental elements – constructs that complete a theoretical framework and unlock vast new capabilities. The inerter in mechanical systems, the memristor in electronics, and the positron in particle physics were each predicted by theoretical symmetry before their practical realization.

Economics and monetary theory may harbor a similar gap. Our entire monetary discourse revolves around two constructs: Commodity money (value acquired through exchange) and Credit money (value created through debt). But a third construct – Claim money (value representing claims on owned, attested wealth) – is conspicuously absent from civilian economic life, despite being the mechanism through which commercial banks actually create the money supply.

This missing element may explain the pathological dynamics of modern economies: the systematic devaluation of labour relative to capital, the mathematical impossibility of aggregate debt repayment, and the continuous transfer of real assets to money issuers. Making Claim money available to ordinary citizens could restore economic optionality that has been absent for centuries.

DeFi systems like MakerDAO now validate this concept at scale, with $5+ billion in stablecoins backed by tokenized real-world assets. But these implementations remain crude – lacking insurance integration, legal finality, and jurisdictional stability. The opportunity exists for jurisdictions to implement superior versions.

For Alberta specifically, this opportunity converges with unique constitutional authority, massive attestable wealth, and urgent economic necessity. The Alberta Buck system provides a complete implementation blueprint. The question is whether Alberta will seize this transformative first-mover advantage – or cede it to competitors already moving. (PDF, Text)

The Pattern of Missing Elements

The Inerter: Completing Mechanical Systems

For over a century, mechanical engineers worked with three fundamental elements: the spring (stores potential energy proportional to displacement), the damper (dissipates energy proportional to velocity), and mass (resists acceleration—force proportional to acceleration). These three elements, combined with levers and linkages, seemed to describe all possible mechanical behaviours.

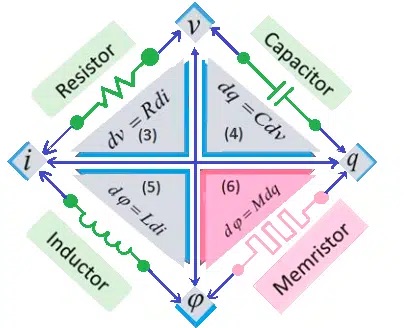

But in 2002, Malcolm Smith at Cambridge University identified a gap. The mechanical-electrical analogy that engineers used to translate between domains was incomplete. Electrical circuits had four fundamental elements – resistor, capacitor, inductor, and the then-hypothetical memristor – but mechanical systems had only three. Where was the mechanical element analogous to inductance in the force-current analogy?

Smith invented the inerter: a two-terminal device where the force is proportional to the relative acceleration between its terminals, rather than absolute acceleration like mass.1 The practical implications were immediate and profound. Formula 1 racing teams adopted inerters within years, achieving suspension performance previously thought impossible. The "missing element" had been hiding in plain sight – theoretically predictable, practically transformative, yet invisible until someone asked the right question.

The Memristor: Completing Electronic Circuits

Leon Chua predicted the memristor in 1971 through pure symmetry arguments.2 Electrical engineers had three fundamental two-terminal elements relating the four basic circuit variables (voltage, locurrent, charge, flux):

The fourth relationship – between charge and magnetic flux – demanded a fourth element. Chua called it the memristor (memory resistor) because its resistance depends on the history of current that has flowed through it.

For 37 years, the memristor remained a theoretical curiosity. Then in 2008, HP Labs announced they had built one.3 The device exhibited exactly the properties Chua had predicted. Today, memristors enable neuromorphic computing architectures that would be impossible with conventional components – artificial synapses that learn and remember, consuming a fraction of the power required by digital alternatives.

The memristor was always possible. The physics permitted it. But until Chua identified the gap in the theoretical framework, no one thought to build one.

The Positron: Completing Particle Physics

Paul Dirac's 1928 equation describing relativistic electrons had an embarrassing feature: it predicted particles with negative energy. Rather than dismiss this as mathematical artifact, Dirac proposed that these solutions represented real particles – electrons with positive charge.

Four years later, Carl Anderson discovered the positron in cosmic ray experiments, exactly matching Dirac's prediction. The "missing" antimatter had been streaming through the universe all along; physicists simply hadn't known to look for it.

The Pattern

These discoveries share a common structure:

- A theoretical framework appears complete

- Symmetry arguments reveal a gap

- The missing element, once identified, proves practically transformative

- In retrospect, the gap seems obvious

What if monetary economics has a similar gap?

The Two Moneys We Know

Ask any economist, politician, or educated civilian about money, and the discussion will inevitably revolve around two categories:

Commodity Money: Value Through Exchange

Commodity money – gold, silver, cattle, shells, Bitcoin – represents value acquired by giving something up. To obtain Commodity money, you must sell something: your labour, your goods, your time. The money is substitutionary: you hold the money instead of what you exchanged for it.

This is the money of classical economics, the money of Austrian theory, the money that "sound money" advocates wish to restore. Its supply is limited by physical scarcity. Its value derives from the commodity itself or from what was sacrificed to obtain it.

Credit Money: Value Through Debt

Credit money – bank deposits, government bonds, commercial paper – represents value created through borrowing. When a bank issues a mortgage, it creates new money by typing numbers into an account. The borrower now has purchasing power they didn't have before, but they also have an obligation to repay with interest.

This is the money of modern economies, created through what Werner (2014)4 documented as ex nihilo credit creation. Its supply is limited only by creditworthiness assessments and regulatory capital requirements. Its value derives from the borrower's promise to repay.

Credit money is also substitutionary in a sense: the borrower acquires purchasing power now in exchange for future purchasing power (principal plus interest). They are buying present consumption with future income.

The Exhaustive Dichotomy?

Every mainstream monetary discussion assumes these two categories exhaust the possibilities. Gold bugs versus fiat advocates versus Bitcoin maxis. Commodity backing versus credit expansion. Hard money versus soft money.

But what if there's a third category – one that is neither Commodity money (acquired through exchange) nor Credit money (created through debt)?

The Missing Element: Claim Money

Definition

Claim money represents a claim on owned, attested, and insured wealth that the owner continues to possess and use. Unlike Commodity money, nothing is given up to acquire it. Unlike Credit money, no debt is created.

The owner holds both the wealth and the money simultaneously, until either:

- The owner redeems the money (releasing the claim), or

- Someone presents the money and claims the underlying wealth

This is fundamentally different from both Commodity and Credit money:

| Property | Commodity Money | Credit Money | Claim Money |

|---|---|---|---|

| Acquired by: | Exchange (sale) | Borrowing (debt) | Attestation (claim) |

| Owner gives up: | Their wealth | Option to sell, income | Option to sell |

| Creates obligation? | No | Yes (repayment) | Yes (redemption) |

| Backed by: | Intrinsic value | Promise to repay | Existing wealth |

| Limited by: | Physical scarcity | Creditworthiness | Attestable wealth |

Why "Claim Money"?

The name Claim money emphasizes the fundamental mechanism: creating money from a claim on owned wealth. It forms a clean categorical triad with Commodity and Credit money, with natural phonetic flow: Commodity, Credit, and Claim.

Alternative names capture different aspects:

- Asset money or wealth money emphasize the backing

- Equity money highlights the equity in owned assets

- Secured money or pledge money stress the lien protection

- Hypothecation money is the specific financial term for something that represents something else

But Claim best captures the essence: you monetize your claim on assets you continue to own.

This concept is not new – numerous economists have proposed versions throughout history, though always constrained by technical limitations:

John Law's Land-Backed Money (1705)

Scottish economist John Law, in Money and Trade Considered, proposed "land-backed money" or "paper money secured by real estate" issued via a national land bank without transferring possession.5 He argued land provided more stable value than volatile silver. His French implementation (1716-1720) failed due to over-issuance and speculation without insurance or attestation mechanisms, but the core insight – monetizing owned real estate – was sound.

Adam Smith and the Real Bills Doctrine (1776)

Adam Smith in The Wealth of Nations endorsed banks issuing notes backed by "real bills" – short-term claims on attested commercial assets and goods.6 This "real bills money" required attestation to ensure legitimate backing. Henry Thornton refined this in 1802, emphasizing the importance of verification. However, it remained confined to short-term trade finance, lacking the indefinite holding period and insurance protection that modern Claim money requires.

Colonial American Land Banks (1730s-1740s)

Benjamin Franklin and others championed "land bank notes" backed by mortgaged real estate – claims without immediate transfer of possession.7 Franklin praised these in his writings for enabling wealth monetization without the debt crises afflicting specie-based systems. Britain suppressed these colonial experiments in 1741, but they demonstrated civilian demand for asset-backed money creation. The missing elements were fungibility mechanisms and insurance integration.

The Swiss WIR Bank (1934-Present)

The WIR Bank operates a "mutual credit" system where Swiss businesses create money backed by their business assets and productive capacity.8 Over 60,000 businesses use WIR, demonstrating 90-year viability. However, WIR remains confined to business-to-business transactions without insurance backing or integration with consumer real estate – the largest civilian wealth category.

These historical precedents validate the "missing element" thesis. Economists repeatedly sensed the gap and proposed asset-backed civilian money creation, but lacked the technology for fungible attestation (blockchain), discount-free stability (insurance), and instant settlement (smart contracts). The legal term hypothecation describes the underlying mechanism – pledging assets as security while retaining possession – but "Claim money" better captures the categorical nature of this third fundamental monetary type.

The Symmetry Argument

Consider the fundamental economic relationships between money, obligation and wealth (and a claim against it, such as an insurer's lien):

| What Produces Money | Mechanism | Result |

|---|---|---|

| Wealth | Sale | Commodity or Credit money |

| Obligation | Unsecured Borrowing | Credit money |

| Wealth + Claim + Obligation | Secured Borrowing | Credit money |

| Wealth + Claim | ??? | ??? |

The last row – converting existing wealth into money while retaining the wealth – is the "missing element." The relationship exists in principle (hypothecation is a well-established legal concept), but no monetary instrument makes it available to ordinary economic participants.

The Curious Exception: Commercial Banks

Here is the peculiar fact that reveals the gap: commercial banks already use Claim money.

When a bank creates a mortgage, it doesn't lend existing deposits (the "loanable funds" theory that textbooks still teach). Instead, it:

- Accepts a claim on the borrower's property (the mortgage lien) and creates an Asset (their promise to repay + the insured value of the asset)

- Creates new money (the deposit Liability) backed by that Asset

- Retains the ability to seize the property if payments stop

The bank has created money from the borrower's wealth and income, not from any pre-existing funds. This is Claim money. The "loan" is really the bank monetizing the borrower's own assets – issuing Credit money and charging interest for the privilege.

Werner (2014)4 empirically demonstrated this process. The Bank of England confirmed it.9 Yet this capability is restricted to licensed banks through regulatory privilege (exemption from "Client Money Rules" that would make anyone else's created deposits illegal).

The missing monetary element isn't missing from the economy. It's missing from civilians.

Historical Examples: Limited Claim Money

Claim money isn't entirely new. Throughout history, people have regularly interacted with certificates representing claims on stored assets:

- Cheques: Claims on bank deposits, circulating as payment until presented for settlement

- Grain elevator receipts: Certificates for grain stored in elevators, sometimes used in trade

- Warehouse receipts: Claims on stored commodities (metals, inventory, goods)

- Bearer instruments: Certificates representing ownership claims on various assets

These instruments functioned as a form of Claim money – the owner retained the underlying asset (in storage or custody) while holding a certificate that could circulate as payment. The grain sits in the elevator; the certificate changes hands. The balance stays in the bank account; the cheque circulates until cleared.

But these historical forms never became viable broad money substitutes for several critical reasons:

The Four Limitations

Slow Ledger Updates

Paper certificates required physical transfer, verification, and settlement. A cheque isn't money until it clears – the paper must be physically presented to the correct parties who then execute the transfer of custody of the actual asset (the bank balance). This settlement delay made certificates cumbersome for daily commerce, limiting their circulation to specific contexts (business payments, large transactions between trusted parties).

Non-Fungibility

Many certificates were tied to specific, non-interchangeable assets. A grain elevator receipt for 100 bushels of Canada Western Red Spring (CWRS) wheat in elevator #7 couldn't be readily exchanged for a receipt for Soft White Wheat in elevator #12. Each certificate represented a unique claim requiring individual verification, quality assessment, and valuation.

Like barter, this lack of fungibility severely limited circulation. Certificates were sometimes fungible (cheques drawn on fiat accounts), sometimes not (grain elevator receipts for specific grades and locations). This made them cumbersome and risky to use in general commerce.

Discount Trading

Even when denominated in fiat currency, certificates traded at discounts reflecting multiple risks:

- Settlement risk: Will the certificate actually be honoured when presented?

- Liquidity risk: Can I actually claim and sell the underlying asset quickly?

- Verification costs: Is the certificate legitimate? Is the asset still there? What's its condition?

- Transaction costs: Transportation, storage fees, quality degradation

A cheque for $100 might be accepted by a merchant at $98 to account for bounce risk. A grain receipt might trade at 95% of spot price due to quality uncertainty, storage fees, and transportation costs to market.

Any instrument trading at a discount is not a broad money substitute – it's a negotiable claim that must be converted to actual money (at a loss) before spending. This fundamental limitation prevented historical Claim money from competing with standard Commodity or Credit money.

Illiquidity of Underlying Assets

The most critical limitation: historical Claim money only worked when the underlying asset was readily liquidatable.

Grain elevator receipts worked because grain is a commodity with liquid markets, standardized grades, and transparent pricing. Warehouse receipts for gold or silver worked for the same reason. These assets could be quickly sold at known market prices with low transaction costs.

But what about real estate? Land? Business equity? Equipment? Inventory?

These assets – which constitute the majority of civilian wealth – couldn't be converted into Claim money (hypothecated into circulating certificates) because:

- No liquid market for immediate sale at known prices

- High transaction costs (legal fees, inspections, appraisals, marketing time)

- Uncertain valuations (subjective, location-dependent, condition-dependent)

- Lengthy settlement processes (weeks to months)

- Unique characteristics requiring individual assessment

A certificate representing "claim on 123 Main Street, assessed value $500,000" would trade at a massive discount, if anyone would accept it at all. Who would take it as payment without: verifying the property exists, confirming ownership, assessing condition, understanding legal encumbrances (liens, easements, zoning), evaluating local market conditions, and determining actual marketability?

The transaction costs would exceed the payment value for most uses. Such certificates could only function between sophisticated parties with legal resources – not as general-purpose money.

This is why historical Claim money remained confined to liquid commodities. The grain in the elevator can be sold tomorrow at posted prices. The house cannot.

The Breakthrough: Fungible Money from Illiquid Assets

This is the core innovation that distinguishes the Alberta Buck from all historical Claim money:

Converting illiquid assets into discount-free, fungible broad money.

By combining four elements that were unavailable (or prohibitively expensive) throughout history:

- Insurance: Guaranteeing minimum liquidation value regardless of market conditions or asset condition. If the house burns down or the market crashes, the insurer pays the claim – the BUCK holder's claim is protected.

- Attestation: Cryptographic verification of ownership, value, and insurance status. Blockchain oracles and smart contracts provide instant, tamper-proof verification that would have required armies of clerks, notaries, and auditors in the paper era.

- Fungibility: All BUCKs are identical and interchangeable, regardless of backing asset. One BUCK backed by a house in Calgary is indistinguishable from one BUCK backed by farmland in Lethbridge or equipment in Edmonton. This eliminates the grain elevator receipt problem.

- Industrial feedback control: PID controllers and dynamic stabilization factors maintain value stability against commodity baskets, preventing the discount trading that plagued historical certificates. The system automatically adjusts supply and credit limits to maintain 1:1 purchasing power parity – producing zero inflation/deflation.

With these four elements, someone can effectively write a cheque against the value of their real estate that:

- Circulates without discount (backed by guaranteed insured value, not uncertain liquidation)

- Never requires immediate liquidation (the asset stays with the owner indefinitely)

- Functions as broad money (spendable, or readily converted to spending, accepted at face value)

- Works with any asset that can be insured and valued (real estate, land, equipment, businesses, commodities, vehicles)

A homeowner with $300,000 equity in their house can create $200,000 in BUCKs (Claim money backed by their equity), spend those BUCKs like cash (or use them to acquire other assets), continue living in and using the house, and only face asset loss if the house is actually destroyed or stolen (triggering an insurance claim) – not from price volatility, market illiquidity, or inability to make interest payments.

The cheque stays in circulation until the homeowner decides to redeem it by selling the house (or until an insurance event occurs). Compare this to a traditional mortgage:

| Aspect | Traditional Mortgage (Credit Money) | Alberta Buck (Claim Money) |

|---|---|---|

| Underlying mechanism: | Bank creates Claim money from your house | You create Claim money from your house |

| Who creates the money: | Bank (from your asset) | You (from your asset) |

| Obligation created: | Debt with interest | Redemption option (no interest) |

| Cost to access value: | $10,000-30,000/year (interest) | $1,000-3,000/year (insurance premium) |

| Risk of asset loss: | Foreclosure (payment default) | Insurance claim (actual loss/damage) |

| Who profits: | Bank (interest on money from your asset) | You (retain asset, minimal cost) |

| Asset liquidity: | Irrelevant (bank forces sale) | Irrelevant (insurance guarantees) |

This is fundamentally different from historical grain receipts or cheques:

- Historical: Liquid assets only, paper-based, discount trading, slow settlement, high verification costs, confined to commodities

- Alberta Buck: Liquid or illiquid assets, blockchain-based, discount-free, instant settlement, automated verification, works with real estate and other major civilian wealth

The technical barriers that confined Claim money to liquid commodities for centuries have been solved. Insurance eliminates liquidation risk. Blockchain eliminates verification costs and settlement delays. Fungibility eliminates barter-like friction. Feedback control eliminates discount trading.

What remains is making this capability – which banks have monopolized for their own profit – available to ordinary citizens.

The Gold Standard: Centralized Claim Money

The most successful historical example of Claim money wasn't commodity certificates – it was the gold-backed US Dollar.

From 1879-1933 domestically (and 1944-1971 internationally via Bretton Woods), USD represented a claim on government-held gold reserves. Dollar holders could present their currency and receive gold at a fixed rate ($20.67/oz initially, $35/oz under Bretton Woods). The government retained the gold; the currency circulated as a claim on it.

This was genuine Claim money operating at scale:

- Fungible: All dollars identical regardless of which gold bar backed them

- Discount-free: Traded at face value due to guaranteed convertibility

- Liquid: Instant settlement, accepted everywhere

- Stable: Gold's scarcity prevented inflation

The gold standard worked far better than grain receipts or warehouse certificates. It powered the most dramatic economic growth in human history (1879-1914), supported international trade, and provided monetary stability across decades.

Yet it had a fatal limitation that ultimately destroyed it: centralized issuance.

The Issuance Monopoly

Under the gold standard, only the government (or its central bank) could issue money against gold reserves. Private citizens who owned gold had three options:

- Sell it to the government for dollars (give up the gold)

- Hold it directly (no monetary benefit, storage costs, verification hassles when spending)

- Deposit it at a bank and borrow against it (debt with interest, risk of foreclosure)

The average citizen with $10,000 in gold /could not/ create $10,000 in circulating currency backed by their gold. That power was reserved exclusively for the government.

This created a structural problem:

- Economic growth required money supply growth

- Money supply growth required government gold acquisition

- Government acquired gold through taxation, borrowing, or trade surpluses

- If private wealth grew faster than government gold reserves, deflation resulted

- Deflation made debts unpayable, triggering depressions (1873-1896, 1929-1933)

The gold standard didn't fail because backing money with assets is unworkable. It failed because centralized issuance created an artificial scarcity that couldn't accommodate economic growth without requiring government to continuously acquire more gold reserves.

When private citizens can't monetize their own wealth, the money supply becomes a bottleneck.

Alberta Buck vs. Gold-Backed USD: The Critical Difference

Both systems back money with owned, attested, insured/secured assets. The transformative difference is who can issue:

| Feature | Gold-Backed USD (1879-1971) | Alberta Buck |

|---|---|---|

| ISSUANCE | ||

| Who can issue money: | Government/Fed only | Any citizen with attestable wealth |

| Reserves required: | Government gold holdings | Private assets (house, land, equipment) |

| Issuance limited by: | Government gold acquisition | Total private wealth in jurisdiction |

| Access mechanism: | Taxation → gold purchase → issue | Insurance → attestation → issue |

| Cost to access: | N/A (citizens can't issue) | Insurance premium (~0.5-1.5%/year) |

| CONVERTIBILITY | ||

| Who can redeem: | Foreign central banks (post-1933) | Anyone holding BUCKs |

| Redemption delivers: | Physical gold | Underlying asset or insurance claim |

| Redemption required: | On demand (until 1971) | Only if issuer defaults or sells asset |

| Convertibility guarantee: | Government promise | Insurance policy + smart contract |

| OPERATIONAL | ||

| Fungibility: | Perfect (all USD identical) | Perfect (all BUCKs identical) |

| Discount trading: | No (government backing) | No (insurance backing) |

| Asset liquidity requirement: | Liquid (gold markets) | Any (insurance eliminates need) |

| Settlement speed: | Instant (paper) / Slow (gold) | Instant (blockchain) |

| Geographic scope: | Global (reserve currency) | Jurisdictional (initially Alberta) |

| WEALTH EFFECTS | ||

| Private wealth monetization: | No (only gov't can issue) | Yes (anyone can create Claim money) |

| Money supply coupled to: | Government gold reserves | Total private wealth |

| Supply bottleneck: | Gov't acquisition rate | None (scales with wealth creation) |

| Deflationary pressure: | Severe (supply can't keep up) | None (supply auto-adjusts) |

| Wealth concentration: | Increases (only gov't monetizes) | Decreases (everyone can monetize) |

| Labour value capture: | No (can't monetize improvements) | Yes (create Claim money from assets) |

The gold standard achieved discount-free, fungible, backed money – but only for government issuance. The Alberta Buck achieves the same plus private issuance.

This single difference has cascading effects.

The Superpower: Private Issuance and Its Cascading Effects

Allowing private citizens to hypothecate their own wealth – creating money backed by assets they own – unleashes effects that ripple through the entire economic system.

1st Order Effects (Direct):

- Economic optionality: Citizens gain a third monetary option beyond sell/borrow

- Cost reduction: Insurance premiums (0.5-1.5%) replace interest (5-15%)

- Asset retention: No forced sale, no foreclosure (only actual loss triggers insurance)

- Supply elasticity: Money supply automatically scales with private wealth, not government reserves

2nd Order Effects (Structural):

- Labour-capital rebalancing: Workers who improve assets can immediately monetize that value without selling or borrowing. A renovation that adds $50K to home value can be converted into $30K BUCKs (Claim money) immediately. Returns to labour can now compound like returns to capital always have.

- Debt decoupling: Economic growth no longer requires debt growth. When private wealth can become money directly, GDP can expand through wealth creation rather than debt creation. The $330 trillion global debt trap becomes escapable.

- Wealth democratization: The power to create money – currently monopolized by governments and banks – becomes available to anyone with attestable wealth. A farmer with land, a homeowner with equity, a business owner with equipment can all access the monetary system as issuers, not just as borrowers or sellers.

- Deflation immunity: Under the gold standard, if private wealth grew faster than government gold reserves, deflation crushed debtors. Under Alberta Buck, private wealth growth is money supply growth. The system can't become supply-constrained because issuers are the wealthy.

3rd Order Effects (Civilizational):

- Generational restoration: When young families can create Claim money from parental equity to buy homes (paying insurance instead of interest), the 10-15 year income multiples collapse back to 3-5 years. Family formation becomes economically viable. Birth rates stabilize. Generational wealth compounds instead of being extracted by lenders.

- Power redistribution: The most transformative effect isn't economic – it's political. When citizens can create money from their own wealth, they become monetarily sovereign in a way that hasn't existed since before central banking. The power to create purchasing power – the fundamental economic power – is no longer concentrated in government and bank boardrooms. It's distributed to anyone who creates value.

- Innovation unleashing: Entrepreneurs who built valuable businesses but lack liquid capital can create Claim money from business assets, equipment, or IP to fund growth – without debt, dilution, or venture capital control. The "valley of death" between prototype and profitability becomes crossable for more innovators.

- Institutional resilience: Systems with distributed issuance are robust to single points of failure. Gold standard collapsed when governments broke convertibility promises (1933, 1971). Alberta Buck has no single point of failure – it's backed by distributed private wealth, enforced by smart contracts and insurance, not political promises.

This is the superpower the gold standard lacked: the ability for ordinary citizens to monetize their own wealth without asking permission from government or banks.

The gold standard demonstrated that Claim money works at scale. The Alberta Buck demonstrates that it works better when everyone can issue, not just the government.

The difference between centralized and distributed issuance isn't incremental. It's the difference between:

- A monetary system that serves government financing needs (gold standard)

- A monetary system that serves wealth creation by everyone (Alberta Buck)

The gold standard was the 20th century's best attempt at sound money. It failed because it couldn't accommodate private wealth creation without government acting as gatekeeper.

The Alberta Buck is the 21st century's answer: all the benefits of asset-backing, none of the centralized bottlenecks.

Consequences of the Gap

The Labour-Capital Imbalance

When only banks can create Claim money – which they then lend out as Credit money on their terms – a structural imbalance emerges. Those with preferred bank relationships access low-cost liquidity unavailable to everyone else, even to those who own substantial wealth. Ordinary citizens with valuable assets – homes, land, businesses – cannot monetize this wealth directly. They can only access it by borrowing at onerous interest rates and risking asset forfeiture on payment default.

Consider a worker who improves their property, builds a business, or increases their skills. This creates real wealth. But to access that wealth as spending power, they must sell the asset (giving it up permanently) or borrow against it (paying interest indefinitely and risking foreclosure on payment default).

Meanwhile, banks simply create Claim money from assets – including the borrower's own assets – and charge interest for the privilege. Those with inside access to this mechanism (financial institutions, well-connected capital owners) can tap low-cost liquidity directly. Everyone else must pay.

The returns to capital compound through direct monetization. The returns to labour are trapped in illiquid assets until sold or borrowed against at extractive rates.

This isn't a moral failing or policy choice. It's the structural consequence of civilians lacking access to the third monetary element.

The Debt Explosion

If Credit money is the only mechanism for creating purchasing power beyond commodity exchange, then economic growth requires debt growth. Every dollar of GDP not covered by Commodity money (gold flows, trade surpluses) must be created as someone's debt.

Global debt now exceeds $330 trillion – over 300% of global GDP.10 This isn't profligacy; it's arithmetic necessity. A credit-money-only system must accumulate debt to function.

The interest on this debt (approximately $15-20 trillion annually at current rates) creates a further impossibility: the money to pay the interest doesn't exist until more debt is created. The system requires exponential debt growth merely to service existing obligations.

Claim money breaks this trap. Money created against existing wealth requires no repayment and generates no interest obligation. Economic activity can expand without corresponding debt expansion.

Asset Forfeiture to Money Issuers

When banks create money through hypothecation (Claim money creation from borrowers' assets) but civilians can only access that money through debt, a transfer mechanism activates: any failure to repay results in asset forfeiture to the money issuer.

Consider: the bank created the mortgage money from nothing, backed by your house. If you fail to repay, the bank seizes your house. The bank has acquired a real asset in exchange for numbers it typed into a computer.

This isn't fraud – it's the legal structure of Credit money creation. But it's a structure that only functions because civilians lack the alternative of creating Claim money from their own wealth directly.

If you could create money against your house yourself (paying insurance premiums rather than interest), "foreclosure" would be impossible. There would be no lender to foreclose. The worst case would be the insurer claiming the asset upon its loss – but the insurer actually paid for that claim through years of premium collection and reserves, unlike the bank that created the mortgage from nothing.

The Generational Collapse

The most visible consequence is the systematic destruction of generational wealth-building. In 1970, the median Canadian home cost 3-5 years of annual income. By 2024, that ratio exceeds 10:1 in major cities – often 15:1 or 20:1.

This isn't a supply or speculation problem. It's a monetary mechanism problem. When home purchases require debt, and debt carries interest exceeding the asset's productive yield, housing becomes a wealth transfer mechanism from buyers to lenders rather than a wealth accumulation tool for families.

Interest payments on a $500,000 mortgage at 5% exceed $125,000 over 30 years – often more than the original construction cost. That $125,000 builds nothing. It's pure seigniorage extracted because civilians lack access to the monetary mechanism banks use.

The consequences accelerate: birth rates collapse (Alberta: 1.41 children per woman, 34% below replacement11) as family formation becomes economically impossible; generational wealth transfer fails; institutional confidence evaporates. Housing policy and affordability programs address symptoms, not the monetary structure that causes them.

The Missing Element Made Available

Why Hasn't This Happened?

The missing monetary element has been absent from civilian life for three reasons – two structural, one technical. The technical barriers have now been solved.

Theoretical Blindness and Regulatory Capture

Economists debated Commodity versus Credit money for centuries, never recognizing that hypothecation – the legal mechanism banks use to create Claim money from borrowers' assets and lend Credit money – could be made available to everyone as a general monetary mechanism. This wasn't accidental. Banks benefit enormously from their monopoly: the interest they charge represents pure seigniorage for creating Claim money from borrowers' own assets. The regulatory structure protecting this privilege isn't accidental – it's maintained by those who profit from it.

Technical Barriers (Now Solved)

Until recently, Claim money faced practical obstacles:

- Attestation: How do you verify what someone owns and its value?

- Insurance: How do you price and manage the risk that backing assets might be lost?

- Fungibility: How do you make claims on heterogeneous assets (houses, gold, cattle) exchangeable?

- Settlement: How do you process redemptions when someone wants to sell the underlying wealth?

Blockchain technology, smart contracts, parametric insurance, and decentralized oracles have solved each of these problems. The technical barriers that made Claim money impractical for centuries have fallen within the last decade.

Validation: Claim Money Emerges in DeFi

As of 2024-2025, the missing monetary element is being implemented at scale in decentralized finance, validating the core thesis while revealing what jurisdictional implementations must add.

MakerDAO, the largest decentralized stablecoin, now accepts tokenized real-world assets as collateral to mint DAI.12 Asset owners tokenize real estate, bonds, or receivables, deposit them as collateral, and mint USD-equivalent DAI – retaining beneficial ownership unless liquidated for collateral value decline. Over $5 billion in DAI now rests on RWA backing.13

This is Claim money: civilians creating broad money from owned wealth without sale or traditional debt. The mechanism works. Demand exists.

But DeFi's implementation remains crude. Without insurance integration or legal recourse, protocols rely on liquidation – forcing asset forfeiture on price volatility rather than actual loss. This replicates the foreclosure dynamic Claim money should prevent. DAI lacks legal tender status, tax settlement authority, or finality outside contractual networks. DeFi proves the concept; it doesn't perfect it.

Meanwhile, Wyoming authorized a state-backed stablecoin in 2024,14 demonstrating sub-federal jurisdictions will innovate in digital currency despite federal monetary monopolies. Wyoming's statute initially mandates cash reserves but doesn't categorically exclude insured RWA backing subject to regulatory evolution. The jurisdictional pathway exists.

Nobel Laureate F. A. Hayek15 argued that the quality of money can only be discovered through competition among issuers, not through monopoly design. DeFi protocols issuing asset-backed stablecoins represent precisely such a discovery process – revealing both demand for Claim money and the inefficiencies imposed by missing institutional layers.

Alberta faces convergence: DeFi validates civilian demand for Claim money. Wyoming validates jurisdictional authority to issue digital currency. The first-mover advantage remains available – but competitors are moving. The choice isn't whether Claim money is viable. The choice is whether Alberta implements the superior version first: insurance-backed, jurisdictionally stable, commodity-valued.

Completing the Monetary Framework

The Analogy Holds

The inerter completed mechanical systems by providing force proportional to relative acceleration. The memristor completed electronic circuits by relating charge to flux. The positron completed particle physics by providing antimatter.

Claim money completes monetary theory by providing a mechanism to convert wealth to money without sale or debt. Like its predecessors, it:

- Was always theoretically possible

- Was partially present (banks use it) but incompletely recognized

- Has transformative practical implications

- Seems obvious in retrospect

The Question Before Us

Engineering disciplines celebrated the discovery of missing elements. Formula 1 teams adopted the inerter within years. HP Labs invested billions in memristor development. Particle physicists built ever-larger colliders to explore antimatter.

Will economics celebrate the recognition of Claim money? Or will regulatory capture and bureaucratic inertia suppress a transformation that threatens incumbent interests?

The answer may depend on whether jurisdictions exist that are willing to implement what theory demands – places where citizens can access the full monetary framework, not just the two elements that benefit existing institutions.

First Mover Advantage

The jurisdiction that first provides civilian access to Claim money will experience something remarkable: capital formation without debt accumulation, asset security without foreclosure risk, and labour compensation commensurate with labour's contribution to value.

Workers will migrate to where their efforts can compound. Capital will flow to where it isn't slowly siphoned through interest payments. Economic growth will decouple from debt growth for the first time in modern history.

The first mover advantage is substantial. The jurisdiction that acts first will attract:

- Workers seeking to monetize the value they create

- Entrepreneurs able to build without debt burdens

- Capital seeking returns unconstrained by extractive intermediaries

- Innovators building the next generation of economic infrastructure

This advantage is available to any jurisdiction willing to see what has been missing and provide what theory predicts must exist.

The missing monetary element is hiding in plain sight. The only question is who will be first to make it available to everyone – and seize the transformative advantages that follow.

Alberta's Moment: From Resource to Monetary Superpower

The Unique Convergence

Alberta stands at a unique convergence of circumstances that may occur only once in economic history. No other jurisdiction combines:

- Massive attestable wealth: $1.6 trillion in real estate, $50+ billion in agricultural assets, centuries of oil and gas reserves, and a population wealthy enough to own substantial capital

- Constitutional authority: Under Canada's Constitution Act, 1867, Section 92(13), Alberta has clear provincial jurisdiction over property and civil rights, including contracts and insurance – the exact legal mechanisms required for Claim money16

- History of financial innovation: Alberta Treasury Branches (ATB Financial) has operated since 1938 outside federal banking jurisdiction, demonstrating Alberta's capacity to create provincial financial institutions that serve public purposes17

- Economic necessity: Alberta sends $23+ billion annually in interest payments to external financial institutions, draining wealth that could be retained locally if Albertans could create Claim money from their own assets instead of borrowing against them

- Technical capability: The blockchain, smart contract, and oracle infrastructure required to implement Claim money at scale now exists and has been proven in production systems

This convergence is rare. Most resource-rich jurisdictions lack constitutional authority. Most jurisdictions with legal authority lack attestable wealth. Alberta has both – and the urgency to act.

The Alberta Buck: Theory Made Concrete

The theoretical framework described in this paper is not hypothetical for Alberta. A complete implementation specification exists: the Alberta Buck.

The Alberta Buck discusses the high-level implications of wealth-backed vs. debt money.

The Alberta Buck Architecture provides the technical design18:

- Blockchain-based tokens (BUCKs) backed by attested, insured claims on private wealth

- NFT-based credit limits (BUCK_CREDIT) scaled by stabilization factors

- Parametric insurance integration to mitigate default risks

- PID controllers and oracles for dynamic supply management

- Valuation against diversified commodity baskets (energy, agriculture, metals, labour)

The Alberta Buck Legal Foundation establishes constitutional viability19:

- Provincial authority over property, contracts, and insurance (s 92(13))

- Non-competition with federal currency powers (s 91(14)-(15))

- Precedents in Colonial American Land Banks, Swiss WIR Bank, and MakerDAO/DAI

- Regulatory pathways through Alberta Securities Commission and Superintendent of Insurance

- Asset retention through Personal Property Security Act (PPSA) liens

This isn't theoretical speculation. It's an implementable system with defined architecture, legal foundation, and operational mechanics. The missing monetary element can be made available to Albertans – the question is when, not whether.

What Alberta Could Become

If Alberta implements the Alberta Buck, making Claim money available to its citizens, the transformation would be immediate and profound:

Economic Impact

- $23+ billion in annual interest savings: Money currently flowing to external lenders stays in Alberta, retained by asset owners who create Claim money from their assets rather than borrow

- 40% reduction in housing costs: Homeowners who create $200K in Claim money from a $500K home pay ~$1,000/year in insurance premiums instead of $10,000/year in mortgage interest

- Asset-backed broad money supply: Alberta creates M2/M3-equivalent money from existing wealth, displacing CAD-denominated commercial borrowing without creating debt

- Labour value capture: Workers who improve assets (renovations, land cultivation, business building) can immediately monetize that increased value without sale or borrowing

Generational Restoration

Most critically, Alberta would restore family formation and generational wealth-building. The housing multiples and collapsing birth rates discussed earlier aren't inevitable – they're consequences of monetary structure.

- Housing becomes achievable: A young Albertan earning $60,000/year could buy a $300,000 home by creating Claim money from family assets (parents' equity, land, vehicles), paying ~$1,500/year in insurance versus $15,000/year in mortgage interest. The income multiple collapses back to achievable levels – generational wealth compounds instead of being extracted by lenders.

- Single-income families viable: Eliminating $10,000-$30,000 in annual interest payments makes family formation economically viable without dual incomes servicing debt.

- Demographics reverse: When young adults can realistically form families, own homes, and build wealth through labour, the demographic crisis resolves. Brain drain reverses as Alberta offers what nowhere else does: monetizing labour into wealth without debt servitude.

Replacing $10,000-$30,000 in annual interest with $1,000-$3,000 in insurance premiums gives families $9,000-$27,000 more annually. That difference is transformative. Change the structure, restore the future.

Strategic Positioning

Alberta would become:

- The world's first jurisdiction to provide civilian access to Claim money, gaining first-mover advantages that compound for decades

- A magnet for capital and talent: Entrepreneurs, investors, and workers migrate to where economic optionality is maximized and debt burdens are minimized

- A living laboratory demonstrating monetary possibilities that mainstream economics claims are impossible, forcing global reconsideration of monetary theory

- A constitutional challenger to federal monetary monopoly – not through confrontation, but through innovation within provincial jurisdiction that proves superior to federal alternatives

- An economic superpower whose wealth stems not from resource extraction but from monetary innovation – sustainable competitive advantage that doesn't deplete with use

The Alternative: Continued Subordination

If Alberta does not act, the consequences accelerate:

Economic: $23+ billion annually draining to external lenders; asset owners losing property to foreclosures on debts that need never exist; labour undervalued relative to capital; economic growth coupled to debt growth; first-mover advantages accruing elsewhere.

Demographic: Youth exodus as brightest minds flee to affordable jurisdictions, losing generations of human capital. Fertility (1.41 children per woman, 34% below replacement11) continues collapsing toward demographic catastrophe. Aging population death spiral: shrinking tax base, exploding healthcare costs, financial unsustainability.

Political: Institutional legitimacy evaporating as each generation sees home ownership and family formation as impossible. Social cohesion fractures. Radicalization follows.

Strategic: Alberta remains locked in commodity extraction while human potential drains away. The province becomes cautionary: wealthy in ground, impoverished in opportunity.

Meanwhile, competitors move. Switzerland's WIR Bank demonstrates 90 years of viability. MakerDAO has tokenized $5+ billion in RWAs, proving civilian demand. Wyoming authorized state-backed stablecoins with RWA pathways. Singapore and Estonia actively examine wealth-backed systems.

The question isn't whether Claim money will emerge – it's whether Alberta leads, follows, or watches its future depart for jurisdictions that acted.

The Challenge

Alberta: you have the wealth, authority, technical capability, and economic necessity. More urgently, you have a generation watching, deciding whether to build their futures here or elsewhere.

They understand the mathematics: 10-15 year housing income multiples versus parents' 3-5; decades of interest payments building nothing; family formation economically impossible. They're making rational decisions: leave for jurisdictions where labour creates wealth, or accept childlessness and asset poverty.

The missing monetary element can be made available. The architecture is designed. The legal foundation is established. The technology exists.

Will you complete the monetary framework – demonstrating labour can compete with capital, growth need not require debt, citizens retain assets, young people form families?

Or will you cede this advantage and watch capital, talent, innovation, and youth flow to jurisdictions that saw what you could not – or would not – see?

The missing element is no longer missing from theory. It's missing only from implementation.

Your young people are making irreversible decisions about where to build their lives. Your birth rates are collapsing. Your future is departing.

Alberta's moment has arrived. The only question is whether Alberta will seize it – before the generation that could build that future chooses to build it elsewhere.

Conclusion: The Element That Completes Everything

For centuries, civilians have had two monetary options: sell something or borrow something. The third – claim something – existed but was reserved for banks through regulatory privilege.

This restriction shaped modern economics in ways accepted as natural: labour systematically undervalued relative to capital, debt outpacing sustainable growth, assets flowing to money issuers through foreclosures on debts that need never exist.

These aren't policy failures. They're structural consequences of a missing element – as predictable as a suspension lacking an inerter or a circuit lacking a memristor.

The element isn't missing. Banks use it daily. It's missing from us.

Making Claim money available to ordinary citizens would transform economic life as profoundly as the inerter transformed vehicle dynamics or the memristor is transforming computing. The theory predicts it. The technology enables it. DeFi validates it. The benefits beckon.

Alberta has unique constitutional authority, massive attestable wealth, proven financial innovation capacity, urgent necessity, complete implementation blueprint – an unparalleled combination.

The missing monetary element has been identified. The architecture exists. The legal foundation is established. The technology works. Competitors are moving.

What remains is will – political courage to see what banks monopolized and make it available to everyone; vision to recognize Alberta's prosperity can stem from monetary innovation, not just resource extraction; boldness to lead rather than follow.

Alberta can pioneer the next evolutionary step: combining the functional broad money dynamics demonstrated by DeFi stablecoins like DAI with full legal recognition, jurisdictional stability, parametric insurance, and integration into the traditional payments system – creating a truly sovereign Claim money.

The Alberta Buck doesn't compete with the federal Canadian Dollar or commercial bank debt; it simply restores to Alberta citizens the option to exercise their legal and constitutional fiscal autonomy, and choose to not use debt at all.

Will you complete the monetary framework?

Footnotes

Smith, Malcolm C. (2002). "Synthesis of Mechanical Networks: The Inerter." IEEE Transactions on Automatic Control.

Chua, Leon O. (1971). "Memristor—The Missing Circuit Element." IEEE Transactions on Circuit Theory.

Strukov, D.B., et al. (2008). "The missing memristor found." Nature 453, 80-83.

Werner, Richard A. (2014). "How do banks create money, and why can other firms not do the same?" An explanation for the coexistence of lending and deposit-taking. International Review of Financial Analysis.

Law, John. Money and Trade Considered, with a Proposal for Supplying the Nation with Money (1705). Law proposed a national land bank that would issue paper money backed by land value, arguing that land provided more stable backing than precious metals due to its productivity and fixed supply. His implementation in France as Contrôleur Général des Finances (1716-1720) collapsed due to over-issuance disconnected from land backing and speculative excess in the Mississippi Company, but the core principle – monetizing real estate without transferring possession – anticipated modern Claim money systems.

Smith, Adam. An Inquiry into the Nature and Causes of the Wealth of Nations (1776), Book II, Chapter II. Smith endorsed the "real bills doctrine" where banks issue notes backed by legitimate commercial bills representing actual goods in production or transit. These bills required attestation of underlying assets, making this an early form of asset-backed money creation. Henry Thornton's An Enquiry into the Nature and Effects of the Paper Credit of Great Britain (1802) refined the doctrine, emphasizing that bills must represent real productive activity rather than speculative finance.

Thayer, Theodore. "The Land-Bank System in the American Colonies" (1953). Journal of Economic History 13(2): 145-159. Colonial land banks in Massachusetts, Pennsylvania, South Carolina, and other colonies issued paper currency backed by mortgages on borrowers' real estate. Landowners could obtain currency by pledging land as collateral while retaining possession and use. Benjamin Franklin defended Pennsylvania's land bank system in multiple writings, noting it provided stable money without the deflation and debt crises caused by specie scarcity. The British Parliament's Currency Act of 1764 effectively suppressed these systems, contributing to colonial economic grievances.

Stodder, James. "Reciprocal Exchange Networks: Implications for Macroeconomic Stability" (2005). Working paper analyzing the WIR Bank (Wirtschaftsring-Genossenschaft), founded in Switzerland in 1934 during the Great Depression. WIR operates a complementary currency system where over 60,000 Swiss businesses create mutual credit backed by their productive capacity and assets. The system demonstrates 90-year stability and counter-cyclical properties, with WIR usage increasing during economic downturns when conventional credit tightens. However, WIR remains confined to business-to-business transactions and lacks integration with consumer real estate markets or insurance mechanisms.

McLeay, Michael, Amar Radia, and Ryland Thomas. (2014). "Money in the Modern Economy" Bank of England Quarterly Bulletin.

Institute of International Finance. Global Debt Monitor, 2024.

Statistics Canada. (2024). "Fertility rates and number of children per woman, by province and territory, 2023" This Statistics Canada report documents provincial fertility rates for 2024, showing Alberta's total fertility rate at 1.41 children per woman, significantly below the replacement rate of 2.1 children per woman.

MakerDAO. "Real-World Asset (RWA) Collateral" (2024). MakerDAO's governance framework accepts tokenized real-world assets including corporate bonds, real estate, invoices, and structured credit as collateral for minting DAI stablecoins. Asset originators tokenize RWAs through legal structures (typically SPVs), obtain credit assessments, and deposit tokens into MakerDAO vaults to generate DAI against overcollateralized positions. This demonstrates permissionless civilian access to Claim money, though with inefficiencies (overcollateralization, liquidation risk) that insurance-based systems would eliminate.

DeFi Llama. "MakerDAO TVL and Collateral Composition" (2024). As of late 2024, MakerDAO manages over $5 billion in total value locked (TVL), with real-world assets representing a growing portion of collateral backing the $4.5+ billion DAI supply. RWA vaults include tokenized US Treasury bonds, corporate credit, trade receivables, and real estate, demonstrating that Claim money scales beyond purely crypto-native collateral. The system's operational success validates civilian demand for wealth-backed money creation.

Wyoming Stable Token Commission. Wyoming Stable Token Act, 2024 Wyo. Sess. Laws ch. 44 (codified at Wyo. Stat. Ann. §§ 13-12-101 to 13-12-115). Wyoming authorized creation of a state-chartered stable token organization to issue USD-backed digital currency, demonstrating sub-federal jurisdictional authority to innovate in digital money despite federal currency monopoly under US Constitution Article I, Section 8. The Act requires 100% reserve backing but does not specify reserve composition, creating regulatory pathway for RWA-backed stablecoins. Wyoming's action establishes precedent that provinces/states can implement monetary innovation within constitutional constraints – directly relevant to Alberta's constitutional capacity under s 92(13).

F.A.Hayek. "Denationalisation of Money – The Argument Refined" (1974). Hayek rallied for competitive private money and rejected legal tender laws as a prerequisite for money, arguing instead that convertibility and competitive exit enforce monetary discipline, and that stability comes from issuer incentives and exit options, not from the nature of the backing commodity.

Constitution Act, 1867, 30 & 31 Vict, c 3, reprinted in RSC 1985, Appendix II, No 5. Section 92(13) grants provinces exclusive jurisdiction over "Property and Civil Rights in the Province," which encompasses contracts, property law, insurance regulation, and civil transactions – the foundational legal mechanisms required for Claim money systems.

ATB Financial Act, RSA 2000, c A-37. This Alberta statute governs Alberta Treasury Branches (ATB Financial), a provincial Crown corporation financial institution operating since 1938. Section 45(1) provides: "The repayment of all deposits with Alberta Treasury Branches and the payment of all interest thereon is guaranteed by the Crown in right of Alberta." ATB operates $60+ billion in assets outside federal Bank Act jurisdiction and without CDIC participation, demonstrating Alberta's constitutional capacity for provincial financial innovation.

Perry Kundert. "The Alberta Buck – Architecture" (2025). Comprehensive technical specification for a blockchain-based wealth-backed token system including: ERC-20 fungible tokens (BUCKs) backed by attested and insured private wealth; NFT-based credit limits (BUCK_CREDIT) scaled by algorithmic stabilization factors (BUCK_K); parametric insurance integration with automated claims processing; PID controllers and decentralized oracles for dynamic supply management; and valuation mechanisms using diversified commodity baskets to provide stable purchasing power independent of CAD.

Perry Kundert. "The Alberta Buck – Legal Foundation" (2025). Constitutional and legal analysis establishing the viability of the Alberta Buck under Canadian federal and Alberta provincial law, including: provincial jurisdiction over property and civil rights (s 92(13)); non-competition with federal currency powers (s 91(14)-(15)); historical precedents (Colonial American Land Banks, Swiss WIR Bank, MakerDAO/DAI); regulatory pathways through Alberta Securities Commission and Superintendent of Insurance; and asset retention mechanisms through Personal Property Security Act (PPSA) liens allowing owners to grant security interests while retaining possession and use.