An Alberta Buck defined in terms of the value of a basket of commodities, and issued based on proof of insured and attested wealth, would dramatically impact private and public debt supply and demand, treasury savings operations, and the supply of broad money presently provided through commercial bank collateralized "lending" operations.

Many historical proposals and attempts have been made to substitute "Hard" wealth-backed money for "Fiat" debt-issued money, with few successes. Pure "Fiat" currencies have dominated global trade and commerce for the last 50 years, for a variety of reasons.

However, the global $332T in public debt, with its approximate $15T/yr required interest transfer – 15% of global $106T GDP or the global $96T M2 money supply 1 2 3 – cannot mathematically be maintained. The question of whether the privilege 4 of issuing debt-backed money actually warrants this transfer of global wealth remains open to debate.

We propose that dynamically issued wealth-backed money has several valuable qualities vs. debt-issued money that have not been adequately explored. These qualities could provide significant "first mover" advantages to the jurisdiction that provides a globally desirable implementation of commodity asset denominated money.

We believe that Alberta is uniquely positioned to benefit from this first mover advantage, and that Alberta's citizens would reap significant benefits from this transition. We also propose that the architectural, legal and technical limitations preventing such a monetary transition have been surmounted. (PDF, Text)

How Could This Possibly Be True?

This paper presents some preposterous claims, and you would be wise to be careful! Usually, bold, counter-cultural claims should be met with a very high bar for proof. And, this is no exception.

However, I ask you to suspend disbelief for a moment. There are complex theories that are provably useful, but whose theoretical foundations are still fluid. The theory underpinning powered flight has oscillated wildly between multiple foundations for 100 years, while we went from Kitty Hawk, to the SR-71 Blackbird, to the Boeing Dreamliner and now the SpaceX Starship. We clearly understand something; but, the present claims that airfoil lift is produced by the Bernoulli principle or Coanda effect5 turns out to be incorrectly described in many engineering textbooks!

Could "the dismal science" of Economics also turn out to be wrong about something that literally every politician and central and commercial banker holds as self-evident and true? Even something that seems to "work", like Fiat monetary systems have for the last 100 years?

"It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning."

– Henry Ford

The thing about self-delusion is that it will continue to "work" – right up to the moment it doesn't. You may believe you understand flight, right up until the moment gravity slaps you dead.

We may be at that moment, economically, in Canada. Our primary goal must be to face facts, and at least do something that is possible; we then have at least a chance of success. Debt-based money is not a closed cycle, and cannot be unwound, reduced or permanently maintained – evidenced by both mathematical derivation and global practical proof. Wealth-backed money can.

"The first step is to establish that something is possible then probability will occur."

– Elon Musk

The $338T tsunami of global indebtedness, consuming 15% of global GDP, and Canadian public debt alone swallowing over 10% of every Canadian family's total net income simply can not continue. The laws of physics guarantees it. When the time inevitably comes, Canada (and by extension Alberta, if we choose to shun monetary autonomy) will have to face the decision: do we throw our banks under the bus, or our citizens? Because it will have to be one or the other. And right now, since the banks are in the driver's seat, it's pretty clear what the default answer will be.

The time has come for Alberta to cease "safely" running after the rat in front of us, step out of the violent flow of history, and take a principled stand.

Stand for Alberta's citizens.

Introduction: The Hidden Cost of Debt-Based Money

Every dollar circulating in Alberta's economy originated as someone's debt to a bank. When an Alberta family takes out a mortgage, the bank creates new money by typing numbers into an account, as Werner6 empirically demonstrated. The family provides real collateral – their future home – and commits to decades of interest payments, while the bank risks no existing assets and creates the loan principal from nothing through accounting entries.

This system imposes a hidden tax on every economic transaction in Alberta. The province's households currently carry $197 billion in mortgage debt and pay approximately $10 billion annually in mortgage interest alone. Alberta businesses shoulder an additional $203 billion in debt with corresponding interest obligations. Meanwhile, the provincial government itself pays $3.2 billion yearly servicing its $82.87 billion debt.

Collectively, Albertans total indebtedness of ~$500 billion transfers $23 billion annually to creditors, including to commercial banks simply for the privilege of using money that banks create costlessly through regulatory exemption.

The alternative – wealth-backed money creation – would enable Albertans to monetize their existing assets without interest obligations. Instead of "borrowing" the full value of a home and paying principal and interest for 25 years, a homeowner could verify the property's value, create Alberta Bucks equivalent to a portion of that net value, and use those units to reduce the total cost of acquiring the property or for other transactions, while retaining full use of the property. The obligation would simply be to redeem the created units if selling the property, with no interest accumulation (or principal repayment terms) on the created units over time.

Alberta loses $63 million /daily/ to interest payments on debt and commercial bank debt-issued money. Analysis reveals that transitioning to wealth-backed money would reduce the effective cost of home ownership by over 40%, eliminate the interest burden that at times forces up to a third of Alberta farms to operate at a loss, and free up over $3 billion annually in provincial debt servicing for productive investment.

The Mechanics of Broad Money Creation

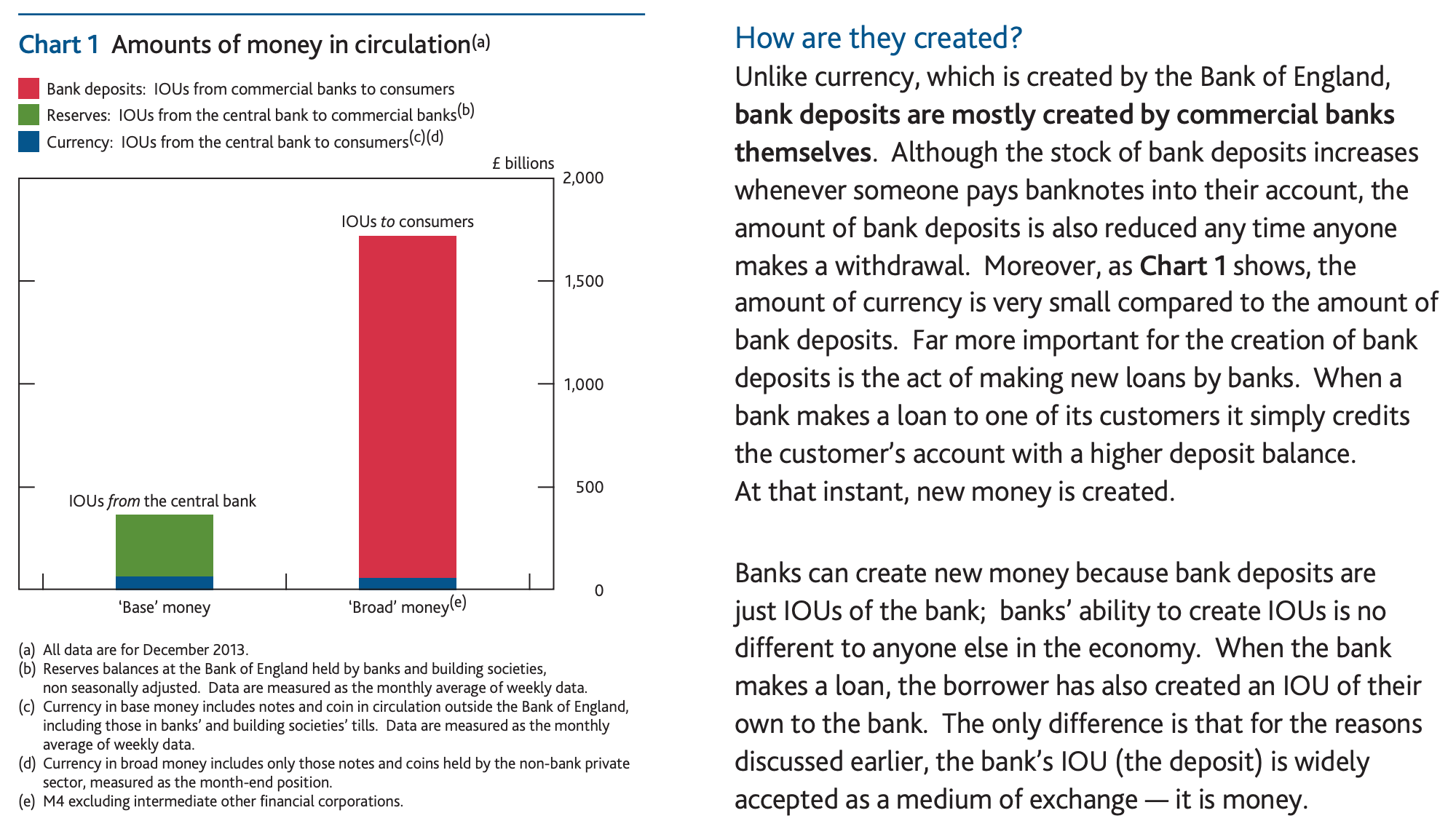

Let's first address this claim that "broad money" is created primarily by commercial bank issuance, incorrectly framed as "lending". To quote the Bank of England's Money in the Modern Economy4:

Most money circulating is indeed created through debt transactions at commercial banks. But what does this really mean, in practice? Is this really "lending", "borrowing" or "loan origination", or is it really something … else?

Lending vs. Issuance: Client Money Rules

Anyone can lend something (business lending is not even regulated), and it is clear to everyone what the preconditions for "lending" are:

- The Lender holds rights to some desirable asset.

- The Borrower wants the asset for some period of time.

-

The parties agree to:

- The value of the asset

- The terms of the transfer of the asset to the Borrower, and an eventual return of "principal" to the Lender.

- The "interest" fees required to cover the Lender's loss of use of the asset plus the risk of the terms on principal and interest payment not being met by the Borrower.

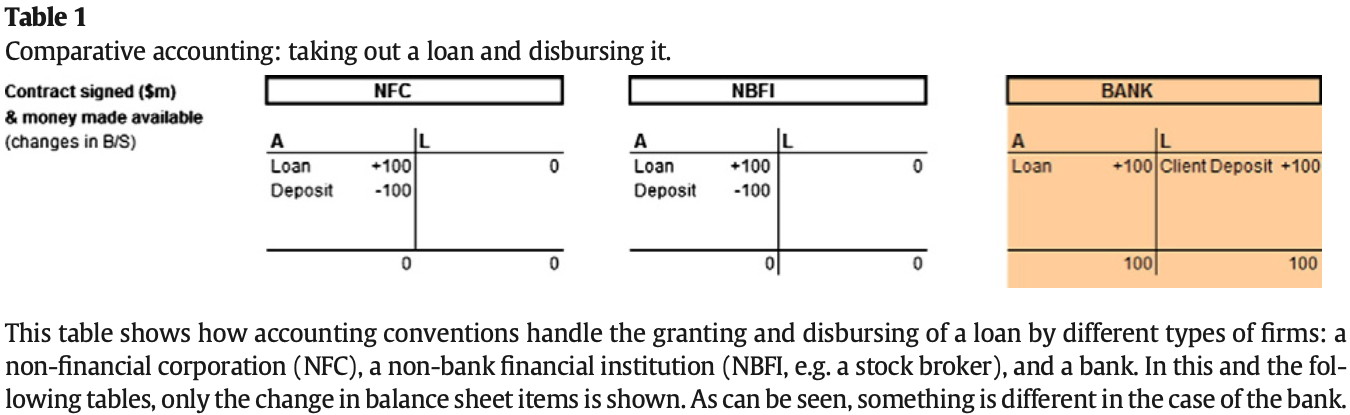

Is this what a commercial bank does? They certainly call it "lending", and intend you to believe that is what is happening. If so, how does this action relate to the broad money supply? Let's see what Werner6 found, by comparing "lending" by a non-financial corporation or citizen (NFC), a non-bank financial institution (NBFI) like a stock broker, and a commercial bank (BANK).

Looking at the accounts after the loan is contracted and disbursed, we can see that the non-BANK balance sheets make sense (remain in balance), but the BANKs' Assets and Liabilities have both increased:

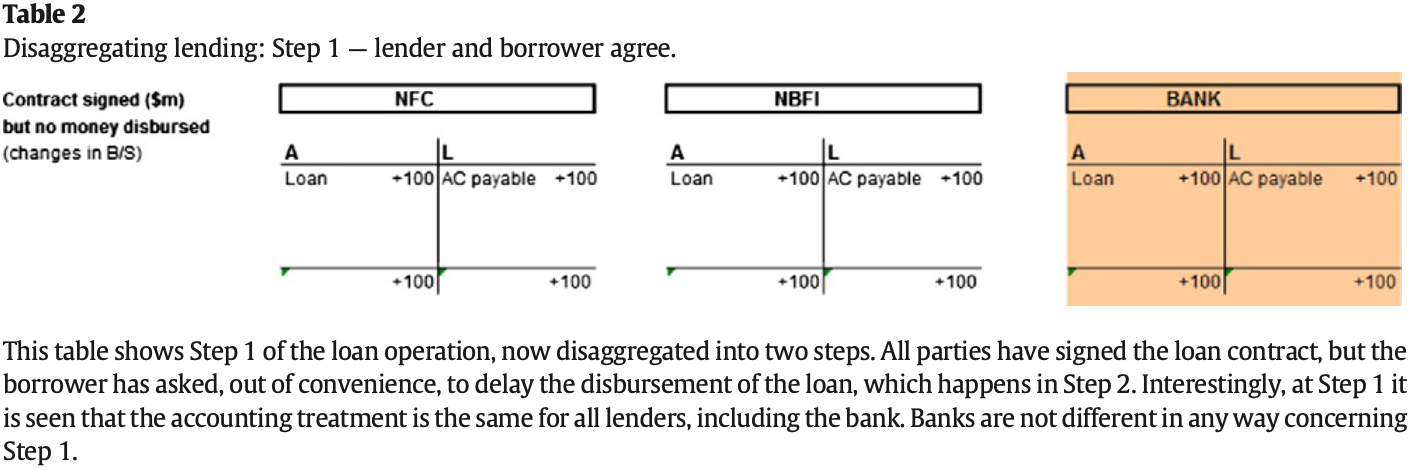

How and when did this occur, and why only for a commercial bank? At the moment a loan contract is signed in Step 1 (but before it is disbursed in Step 2), all 3 entities balance sheets are in agreement:

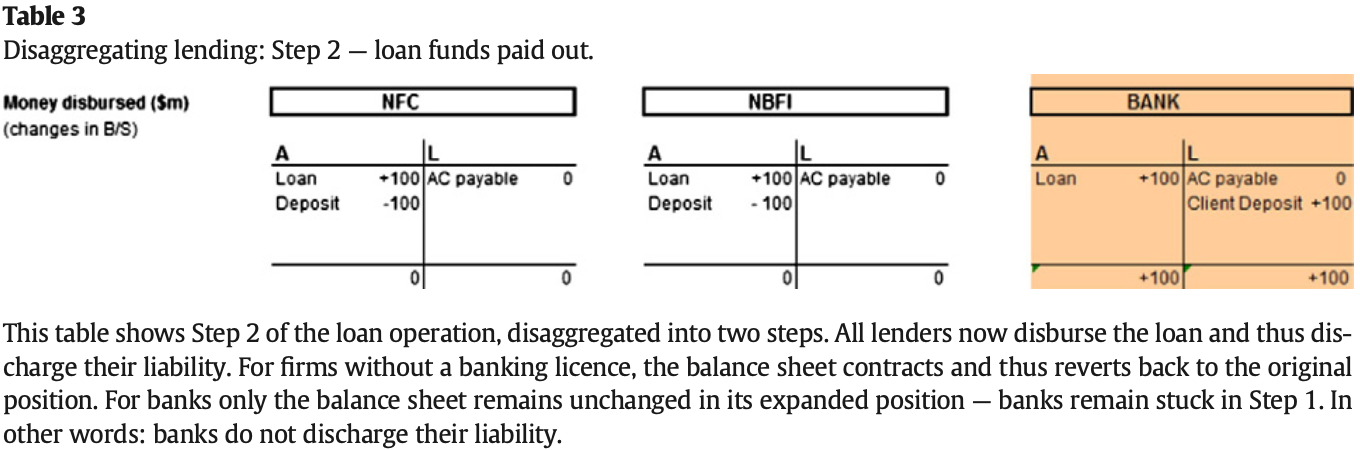

Here's where things go pear-shaped. To quote Werner:

However, as can be seen in Table 3, the story is quite different for the bank. Surprisingly, we find that unlike the other firms whose balance sheets shrank back in Step 2, the bank's accounts seem in standstill, unchanged from Step 1. The total balance sheet remains lengthened. No balance is drawn down to make a payment to the borrower.

As it turns out, what you and I (and everyone) agrees is "lending", is not what commercial banks do:

So, we see that commercial banks do not have "assets" that they "lend"; they create Liabilities which they do not pay and call them Customer Deposits. If anyone else did this (receiving your promise of loan repayment as an Asset, and creating some numbers in a Liability account and calling it a "Deposit"), of course these "Deposits" would be considered worthless. But, by convention, these Deposits are considered "broad money" – all money that can be readily spent or turned into spending.

In summary: commercial bank "lending" is actually broad money "issuance", and since the Liability "Deposit" is created ex-nihilo, the Interest and Repayment terms of the loan are completely arbitrary. They could make the terms zero (no Principal repayment until the loan is concluded, and no Interest due for the duration) – and they would lose nothing, and endure no additional risk (since the collateral asset is insured, at the owners expense, payable to the bank). Their balance sheet would expand when the broad money was created. Then it would contract when the money was returned and destroyed.

Since there is no asset that the bank loses access to, the function of Interest (to recompense the Lender for loss of use of their asset) and Principal repayment (to restore the asset or equivalent back to the Lender in a reasonable time) are entirely arbitrary.

They essentially serve the function of allowing the commercial bank to package up these issuances into what appear to be broad money "loans" in tranches of similar "risk" and "return" (just like a real loan issued by a non-bank actor), and spin them off as CLOs (Collateralized Loan Obligations) to crystalize the "loan" profits, and get the asset/liability off of their books.

Seigniorage: A Transfer of Wealth to the Privileged

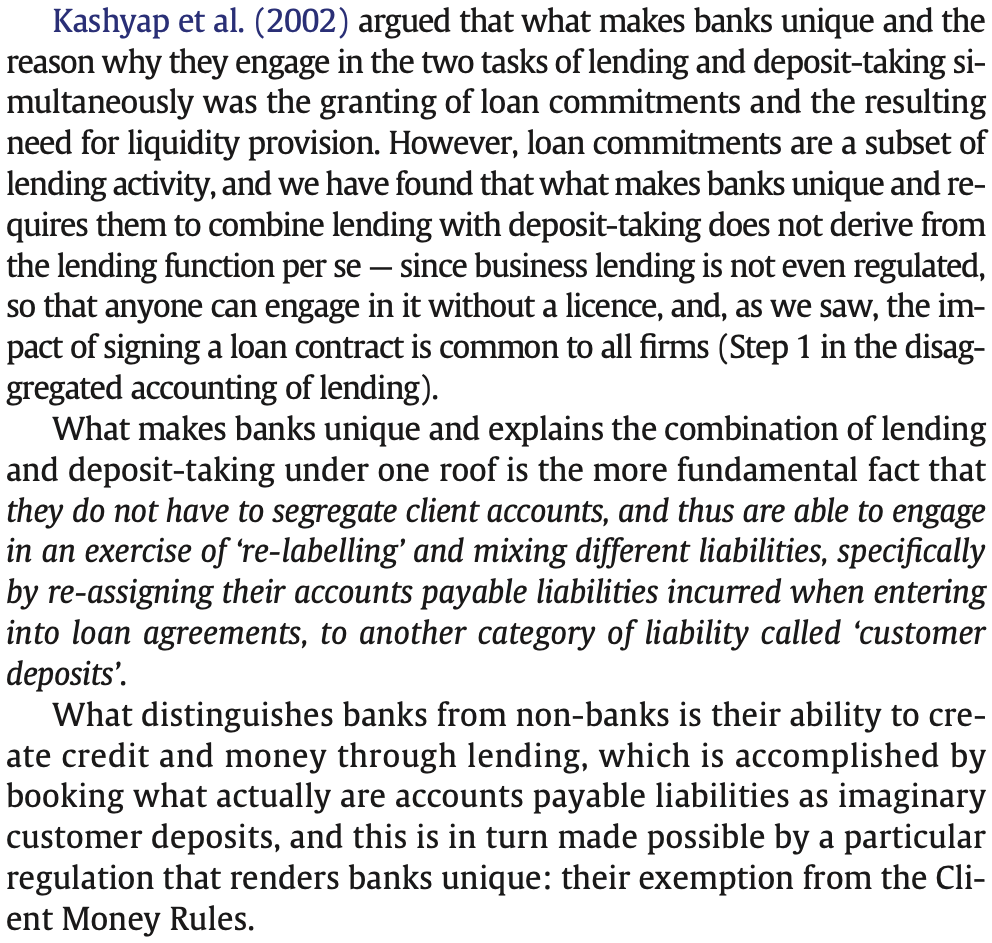

We have established that commercial banks do not "lend" – they issue broad money ex-nihilo. But what is the economic consequence of this privilege? To understand the magnitude, we must compare the returns of a commercial bank against a private lender who must first accumulate capital to lend.

The private lender faces a fundamental cost: they must pay for the capital they lend. Whether they borrow from depositors, issue bonds, or use investor equity, there is a cost of capital. The commercial bank, by contrast, creates the deposit liability ex-nihilo – at zero cost.

Commercial banks are granted a remarkable privilege: they alone may create money by typing numbers into accounts. This privilege – called 'seigniorage' when exercised by sovereigns minting coins – transfers billions annually from borrowers who provide real collateral and decades of labour, to institutions that contribute accounting entries. The privilege is legal. Whether it is just is the question Alberta must answer. (The Alberta Buck proposal addresses this by allowing citizens to monetize their own wealth directly, without paying seigniorage to banks – see Wealth-Backed Broad Money Issuance below.)

To illustrate, let's examine a simple loan: $100,000 at 10% APR for 10 years.

The Private Lender's Economics

A private lender must first accumulate or borrow $100,000. Suppose they pay 5% APR to their capital source (depositors or investors). Over 10 years:

- Interest received from borrower: $62,745

- Capital cost paid to depositors: $17,912

- Net profit: $44,834

The private lender earns a 5% net spread (10% revenue minus 5% cost). This is the economic return on real lending – where capital must be accumulated, deployed, and the lender bears the opportunity cost of losing access to that capital.

The Commercial Bank's Economics

The commercial bank creates $100,000 in deposits ex-nihilo when the loan is signed. Over 10 years:

- Interest received from borrower: $62,745

- Capital cost paid: $0

- Net profit: $62,745

The bank earns a 10% net spread – double that of the private lender. But the bank deployed no capital8. Their balance sheet simply expanded. As the borrower makes payments, the principal reduces the deposit liability (destroying the broad money), and the interest is kept as pure profit.

The Seigniorage: $17,912 Per $100,000 Loan

The difference – $17,912 over 10 years on a $100,000 loan – is seigniorage9: the privilege of issuing money rather than lending it.

======================================================================

SEIGNIORAGE COMPARISON: $100,000 LOAN @ 10% APR FOR 10 YEARS

======================================================================

(Annual payment: $16,274.54)

Private Lender (must pay 5% for capital):

Interest received: $ 62,745

Capital cost paid: $ 17,912

NET PROFIT: $ 44,834

Commercial Bank (ex-nihilo issuance):

Interest received: $ 62,745

Capital cost paid: $ 0

NET PROFIT: $ 62,745

>>> SEIGNIORAGE PER LOAN: $ 17,912

(Bank earns 1.40x more on identical loan)

======================================================================

EARLY SALE SCENARIO: SELL LOAN AFTER 1 YEAR

======================================================================

After Year 1:

Annual payment received: $ 16,275

Principal portion: $ 6,275

Interest portion: $ 10,000

Remaining balance owed: $ 93,725

Sale price (NPV at par, 10% market rate):

Remaining: 9 payments of $16,274.54

NPV at 10%: $ 93,725

(No premium/discount - market rate unchanged)

PRIVATE LENDER - Full Cash Flow:

CASH IN:

Year 1 payment: $ 16,275

Sale proceeds (NPV): $ 93,725

TOTAL IN: $ 110,000

CASH OUT:

Repay capital source: $ 100,000

Capital cost (5% × 1 year): $ 5,000

TOTAL OUT: $ 105,000

NET PROFIT: $ 5,000

COMMERCIAL BANK - Full Cash Flow:

CASH IN:

Year 1 payment: $ 16,275

Sale proceeds (NPV): $ 93,725

TOTAL IN: $ 110,000

CASH OUT:

Destroy deposit liability: $ 100,000

Capital cost: $ 0

TOTAL OUT: $ 100,000

NET PROFIT: $ 10,000

>>> SEIGNIORAGE (1 year): $ 5,000

Private lender profit: $ 5,000

Commercial bank profit: $ 10,000

Ratio: 2.00x

(Exactly the $5,000 annual capital cost saved)

The pattern is clear: seigniorage equals precisely the capital cost that the commercial bank does not pay. Whether holding the loan to maturity or selling it immediately (as a CLO or whole loan sale), the bank's advantage is the entire capital cost that would burden a private lender.

One might object that banks provide genuine services such as credit assessment, payment infrastructure, and financial intermediation that justify their returns. This is true, and the BUCK proposal doesn't eliminate these services; private attestors, insurers, and market-makers will perform them. What we object to is not the services but the monopoly on money creation that allows banks to charge for services they don't actually provide; namely, the "lending" of capital they never had. A private lender providing identical services would earn lower returns because they must first accumulate or borrow the capital they deploy.

The Scale of the Transfer

Alberta's government, households and businesses carry about $500 billion in debt to creditors and commercial banks. If we conservatively estimate that half represents mortgages and business loans where commercial banks extracted seigniorage (as opposed to other forms of credit), that is $250 billion in principal.

At a 5% seigniorage rate (the difference between what banks earn and what a private lender would earn after paying for capital), this represents approximately $12.5 billion per year in wealth transfer from Albertans to financial institutions – purely as payment for the privilege of ex-nihilo money issuance.

This is not payment for:

- Risk assessment (both banks and private lenders must assess risk)

- Loan servicing (both must service loans)

- Capital deployment (banks deploy no capital)

This $12.5 billion per year is payment solely for the regulatory privilege of violating Client Money Rules – creating deposit liabilities without transferring any asset.

Globally (assuming similar fraction of commercial bank issuance), with total debt exceeding $330 trillion, the annual seigniorage transfer approaches /$8.5 trillion per year/ – roughly 8% of global GDP2, extracted year after year, simply for the privilege of issuing the money supply.

Historical Parallels: The Tribute Economies of the Past

History records many systems where a privileged class extracted wealth from productive society through structural advantage rather than productive contribution. We now regard these arrangements as oppressive:

Feudalism's Labour Rents: Medieval serfs owed corvée – compulsory labour for the lord's benefit – typically 20-30% of their working time. They could not refuse; it was the price of accessing land they could not own. Today, we call this serfdom.

Colonial Tribute Systems: The Spanish encomienda and mita systems forced Indigenous peoples to provide labour and goods to Spanish settlers. The British East India Company extracted similar tribute from Bengal – contributing to famines that killed millions. We call this exploitation.

Slavery's Unpaid Labour: The antebellum American South extracted the entire productive output of enslaved people, providing only subsistence in return. We call this evil.

What distinguished these systems was not that they were illegal – they were perfectly legal, sanctioned by the Crown, the Church, or Constitutional law. What made them oppressive was the structural extraction: a privileged class received wealth flows without commensurate productive contribution, enforced by legal monopoly.

The commercial banking seigniorage operates identically:

- Legal monopoly: Only commercial banks may create deposit liabilities without transferring assets (violating Client Money Rules that would make anyone else's "deposits" worthless).

- Structural extraction: Every mortgage, business loan, and consumer credit line generates seigniorage – wealth transfer without productive contribution beyond what a private lender provides.

- Inescapable: Citizens cannot opt out. To participate in the modern economy requires broad money (bank deposits), which can only be created through bank debt issuance or government deficit spending.

- Compounding: Unlike a one-time tax, seigniorage extracts continuously. Albertan's $23 billion annual interest payments include approximately $12.5 billion in pure seigniorage – year after year, generation after generation.

When the Bank of England finally acknowledged in 2014 that "commercial banks create money", it was not announcing a new practice – it was admitting a centuries-old arrangement that had been carefully obscured by the language of "lending" and "deposits."

The question we must ask ourselves: if we would not tolerate corvée labour, colonial tribute, or chattel slavery today – systems that extracted productive output from civilization for the benefit of the privileged few – why do we tolerate a system that extracts 8% of global GDP, indefinitely, to pay commercial interests seignorage on the global money supply?

Why This Matters for the Alberta Buck

The Alberta Buck proposal does not seek to eliminate the function that commercial banks serve (risk assessment, loan servicing, payment infrastructure). It seeks to eliminate the seigniorage privilege – the extraction of wealth solely for creating money ex-nihilo.

By allowing citizens to issue wealth-backed broad money (BUCK tokens) against attested, insured assets, we extend the same privilege currently reserved for commercial banks – but without creating debt.

A citizen issuing BUCKs against their home equity or mineral rights:

- Pays no "interest" (there is no loan)

- Pays no seigniorage (there is no bank or king)

- Retains ownership of their wealth (the

BUCK_CREDITNFT represents a claim, not a sale) - Creates purchasing power from wealth rather than through debt

This is not radical. This is not experimental. This is simply extending to all citizens the same power commercial banks have exercised for centuries – the power to monetize value without first borrowing money into existence.

The difference is that when citizens issue BUCKs, there is no tribute, no extraction, no serfdom. There is only the monetization of wealth that already exists, transformed into fungible purchasing power, without the $12.5 billion annual transfer to financial institutions that currently defines Alberta's monetary system.

If we believe that feudal corvée was oppressive, that colonial tribute was exploitative, and that chattel slavery was evil – all because they extracted wealth through structural privilege and force rather than productive contribution and free agreement – then we must ask:

What do we call a system that extracts $12.5 billion per year from our fellow Alberta citizens, indefinitely, for the privilege of creating the money we need to survive?

And more importantly: what will we do about it?

If historical tribute systems are condemned for privileging the few, shouldn't we scrutinize a modern system extracting billions annually for the same monetary privilege? Democratizing asset-backed issuance could capture this privilege for citizens, turning extraction into empowerment.

Wealth-Backed Broad Money Issuance

Now that we understand what "lending" is, and how it differs from commercial bank "issuance" of broad money, let's see whether or not we can deploy these principles to allow private citizens to legally issue broad money – without resorting to any of the regulatory exemptions and privileges allowed commercial banks.

Our goals are to:

- Issue "broad money" – something that can be readily spent or turned into spending.

- Use standard, compliant balance sheet operations – no violating Client Money Rules.

- Founded on basic, strong contract and common law – unquestioned legal foundation.

What Is the Alberta Buck? A Measurement, Not a Currency

The Alberta Buck is not a currency in any legal sense – it is a Real World Asset (RWA) token that represents a measurement of the aggregate Buck-denominated value of all underlying wealth pledged to the system. This distinction is fundamental to understanding both its legal foundation and its economic function.

Consider how existing RWA tokens operate:

- Kinesis KAU: An RWA token representing attested gold held in approved vaults. The gold owner retains beneficial ownership; the KAU token simply represents and makes transferable the measured value of that gold. The owner can exchange KAU for USDC, use the funds, later acquire equivalent KAU, and redeem their gold. No "lending" occurred; just monetization of existing wealth.

- Paxos PAXG: Similarly, an RWA token representing gold holdings, tradeable on DeFi platforms.

- Tether USDT: Approximately 20% backed by non-monetary assets (gold, Bitcoin) – Tether is essentially monetizing its own Real-World Assets into broad money tokens.

The Alberta Buck operates identically: when a homeowner obtains a BUCK_CREDIT NFT for their

property and mints BUCKs, they have not "created money" – they have converted illiquid wealth into

liquid form, exactly as they would by depositing gold at Kinesis. The underlying wealth existed

before, during, and after the transaction.

The distinction between currency issuance and wealth measurement is critical:

| Currency Issuance (Federal) | Wealth Measurement (Provincial/Private) |

|---|---|

| Creates new monetary value ex nihilo | Represents pre-existing value in liquid form |

| Backed by government fiat or debt | Backed by attested, insured private assets |

| Designated as legal tender | No legal tender status; voluntary acceptance |

| Controlled by central bank policy | Controlled by aggregate participant wealth |

| Requires federal regulatory framework | Operates under provincial property/contract law |

Many instruments already function as "broad money" – something that can be spent or readily turned into spending – without being federally recognized currency:

| Instrument | Backing | Legal Status | Federal Authorization |

|---|---|---|---|

| Canadian Tire Money | Merchant credit | Private token | None required |

| Starbucks Card Balance | Prepaid funds | Gift card | Consumer regs only |

| USDT Stablecoin | USD + assets | Cryptocurrency | Varies by jurisdiction |

| Airline Miles | Future service | Loyalty program | None required |

| Grain Elevator Receipts | Physical grain | Negotiable warehouse receipt | Provincial regulation |

| Alberta Buck | Attested wealth | RWA token | None required |

Each of these joins "broad money" simply by being sufficiently useful, trusted, and liquid. None required federal currency authorization because none claims to be currency – they are private value transfer mechanisms operating under contract law.

How the Alberta Buck Works

Having established what the BUCK is conceptually, let's examine how it works.

The Alberta Buck is defined as being:

- Equal in value to a basket of long-term value-stable Canadian commodities, and

- Issued backed by a claim on any attested and insured wealth.

It can be:

- Exchanged for existing broad money (eg. via a Uniswap BUCK/USDT DeFi pool), or

- Used directly as broad money for selling, buying, borrowing or lending because it's stable.

The BUCK operates at two levels:

Level 1: BUCK_CREDIT NFTs (Individual Asset Tokenization)

When an asset owner wishes to monetize their wealth:

- An insurer attests and insures the asset's value

- A

BUCK_CREDITNFT is created representing that asset's value denominated in Bucks - The NFT is linked to the owner's Ethereum account

-

The owner retains full use and beneficial ownership of the underlying asset

- The insurer has standard legal liens and other recourse when insurable events occur

This is precisely equivalent to depositing gold at Kinesis and receiving the ability to mint KAU.

The BUCK_CREDIT NFT is simply an RWA token representing the insured value of a specific asset.

Level 2: BUCK ERC-20 Tokens (Aggregate Value Representation)

The BUCK tokens themselves represent a proportional claim on the aggregate value of all Level 1

BUCK_CREDIT NFTs in the system. When an account holder mints BUCKs:

- They are not "creating currency" – they are expressing a portion of their already-attested wealth in transferable form

- The total BUCK supply is strictly bounded by the sum of all

BUCK_CREDITlimits (times theBUCK_Kstabilization factor) - BUCKs are fully fungible – they represent value backed by the entire pool of attested assets, not any specific asset. Their value is defined as being worth a certain basket of commodities, but the actual backing need not include any of those specific commodities (eg. Uranium) – probably more gold and live chickens than yellowcake…

Practically, to accomplish all this, the BUCK needs to solve 3 distinct problems in an automated, decentralized fashion with high public confidence:

- Issuance based on a legal claim on real wealth; loss of that wealth results in a withdrawal of BUCKs.

- General in/deflation dynamically produces a broad issuance/withdrawal of BUCKs to stabilize value.

- Individual accounts that go negative are recovered, at the risk and expense of the account holder.

The solutions must separate legal and regulatory concerns (which grind away slowly, at the speed of the courts), from parametric concerns which must be executed on a transaction by transaction basis.

There are several ways to accomplish this separation of concerns, using various combinations of traditional Legal contracts and parametric "Smart" contracts implemented on a variety of platforms/languages (Ethereum, Solana, Holochain). The following three sections examine one immediately implementable approach using Ethereum smart contracts written in Solidity, interfacing with insurance providers. If you're not interested in these technical implementation details, you may prefer to skip ahead to Would A Commodity-defined BUCK Be Stable? which demonstrates that commodity-basket money would be significantly more stable than the CAD$ has been over the last 50 years. For detailed analysis of constitutional constraints and legal objections, see the companion article Addressing Common Objections.

BUCK_CREDIT NFT: Parametric Asset Insurance

As described above, the BUCK_CREDIT NFT represents an insurer's attestation of asset value. The

key innovation is parametric insurance: instead of traditional claims processing, smart contracts

automatically trigger payouts based on predefined conditions. If you write off your insured car,

the insurance company pays out your claim but seizes the wrecked car; the BUCK system works

similarly, but with automated blockchain enforcement.

This will require some integration with existing insurers and the creation of a Parametric Insurance product, which will limit the types of assets usable to back the Alberta Buck initially. However, globally RWA tokenization is exploding, and RWA insurance is developing rapidly to address this sector, so we are confident that we can work with insurers to bring appropriate products to market.

Initially, some of the simplest BUCK monetization targets will be:

-

Cryptocurrency held in a locking contract with an insurer

- If the owner fails to sign on time, the contract pays out BUCKs from the insurer, and the insurer claims the backing cryptocurrency.

-

Valuable collateral held by a trusted third party (eg. precious metals held in a depository)

- If the third party fails to sign a report on the assets, the contract pays out BUCKs, and the insurer claims the collateral assets.

Later, as insurers adapt their existing products to support blockchain attestation:

-

Home and auto insurance (leveraging established insurance products with new parametric interfaces)

- If the asset is damaged or destroyed, the insurance automatically pays BUCKs to cover the

owner's outstanding BUCK liability (reducing their

BUCK_CREDITto match the reduced asset value), and the insurer takes over the damaged asset or salvage rights as normal.

- If the asset is damaged or destroyed, the insurance automatically pays BUCKs to cover the

owner's outstanding BUCK liability (reducing their

None of the infrastructure or technology underpinning these types of insurance products is a significant technological risk.

BUCK ERC-20 Issuance: Value Stabilization Factor

The BUCK ERC-20 interface implements dynamic issuance; you can send BUCKs from the Ethereum account

up to your BUCK_CREDIT limit × the current BUCK_K10 Value Stabilisation Factor.

Until all components of the BUCK commodity basket are available in online DeFi pools, BUCK_K will

be the median of multiple authorized independent external Oracles computing the current target

valuation of BUCK's commodity basket in terms of each BUCK/XXX pool (eg. USDT, CADT, ETH, wBTC,

PAXG). Each external Oracle will run one of a variety of differing PID (Proportional Integral

Differential, with and without Kalman filtering), MPC (Model Predictive Control), etc. controllers,

and the median of the computed BUCK_K Value Stabilisation Factors will be used.

In simple terms, these automated control systems continuously monitor the BUCK's trading price

against its target commodity basket value, and adjust how many BUCKs each person can issue (by

changing the BUCK_K multiplier) to keep the BUCK stable – much like a thermostat maintains room

temperature by adjusting heating and cooling.

All of these control techniques have been long employed in industrial automation, and are simple

enough to model that astute market makers can run "tighter" controls and front-run the control

algorithm; this will have the result that market makers can detect inflation/deflation of

eg. BUCK/PAXG early and pre-emptively sell BUCK / buy PAXG when they detect BUCK inflation, on the

assumption that the Oracle-produced BUCK_K response will eventually take effect, yielding the

market-maker a quick ROI. However; the net effect will be an automatic correction of BUCK/PAXG

without requiring as large a BUCK_K control impulse.

Conversely, if some whale attempts to corner the market and influence eg. BUCK/PAXG or BUCK/USDT by

selling large amount of BUCKs via the DeFi pools, the response of the BUCK_K Oracles (which all

have a certain amount of kP and kD PID factor) will spike the BUCK_K multiplier, as the

process-value/setpoint Proportional (error) and Differential (rate of change) spike. The immediate

flood of BUCK liquidity (remember, every account's limit is BUCK_CREDIT NFT × BUCK_K), and the

obvious mis-pricing of eg. BUCK/USDT vs. the inherent value of the BUCK's basket of commodities,

which is publicly known and computed in real time, will allow many independent BUCK_CREDIT

accounts to immediately issue BUCKs and "soak up" the artificially depressed BUCK/USDT and BUCK/PAXG

DeFi pool assets. Basically, the BUCK system will systematically transfer the assets of the Whale to the

participating BUCK credit holders. As soon as the manipulation ceases, the new USDT and PAXG

holders can cash in their gains, either returning their BUCK holdings to their prior levels (plus

any profit), or just go on a well-deserved vacation. Thanks, Whales!

BUCK ERC-20: Parametric Default Insurance

When you mint BUCKs against your BUCK_CREDIT NFT, you create a liability – an obligation to

eventually return those BUCKs (or their value) when you sell the backing asset. Your "available

credit" is: BUCK_CREDIT limit × BUCK_K minus outstanding BUCKs minted. The closer your minted

BUCKs approach your credit limit, the more costly your Parametric Default Insurance becomes.

Regardless of the effectiveness of asset valuation or insurance, there exists the possibility that

an individual account may go into default – outstanding BUCKs exceed the current BUCK_CREDIT

limit × BUCK_K – due to changes in BUCK_K or asset revaluation. This is a risk with any

dynamic issuance system.

When the BUCK ERC20.mint API is called, a portion of the proceeds proportional to the default risk of

the account is applied to support the default insurance. This could be purely a risk premium, or an

investment in a mutual insurance scheme (fractional ownership of the risk pool), or some combination.

Since the risk is open-ended (the minted balance could remain at risk for an indeterminate period),

the mutual insurance scheme where the client invests a certain (risk-calculated) percentage of their

BUCKs in the insurance pool is likely to be best – the act of minting BUCKs supports funding the

BUCK default risk pool, and the parametric insurance pools' profit margin (algorithmically set to

eg. 10% APR) pays the client's risk premium. Later, if the client defaults, the invested assets

would be used as the deductible; otherwise, they are returned when the client reduces (via

ERC20.burn) the draw on their BUCK_CREDIT.

With the mechanics of wealth-backed money established, we turn to a critical question: would such a system actually provide stable value?

Would A Commodity-defined BUCK Be Stable?

So, if broad money could be created from claims on wealth instead of the creation of debt, and the implementation rests on a sound legal foundation, and the mechanics are achievable using current technology; what about the value reference?

A primary determinant of monetary suitability is price stability. Would commodity price defined money be stable?

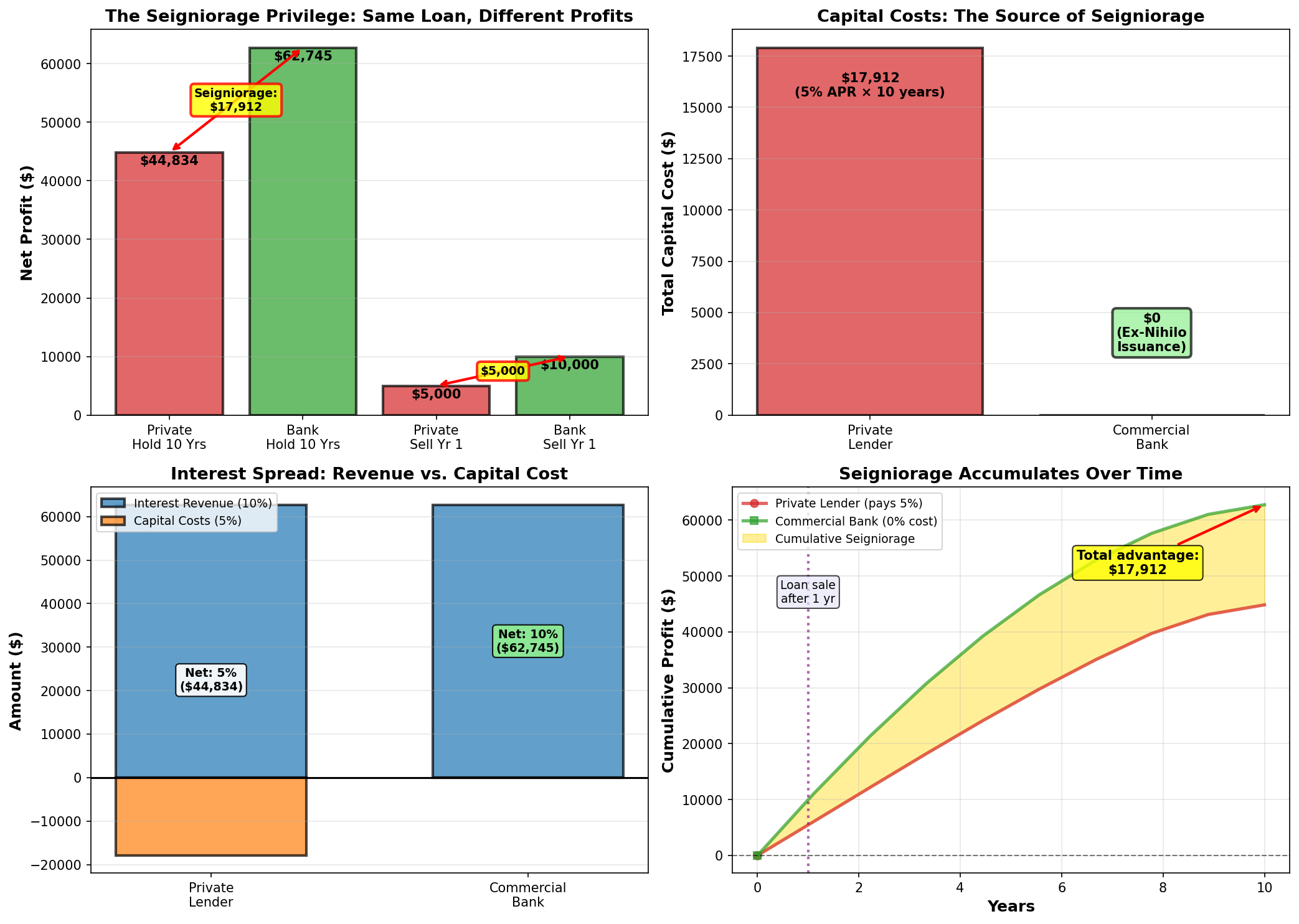

Canadian Commodities vs. CAD$

Let's look at the Bank of Canada BCPI11 index (a basket of Canadian commodities), in terms of USD$, CAD$ and inflation-adjusted CAD$.

This demonstrates that a BUCK defined solely in terms of Canadian base commodities would have fared much better in terms of stability than the CAD$ has. As technology improves, the costs of mining and processing commodities has generally gone down, which would result in a currency that deflates (becomes more valuable) over time if this is the sole value reference.

The Alberta Buck represents more than just the "stuff" things are made of; it should also represent the value of how things get made. The cost of the labour (including living costs and taxes) must also be represented.

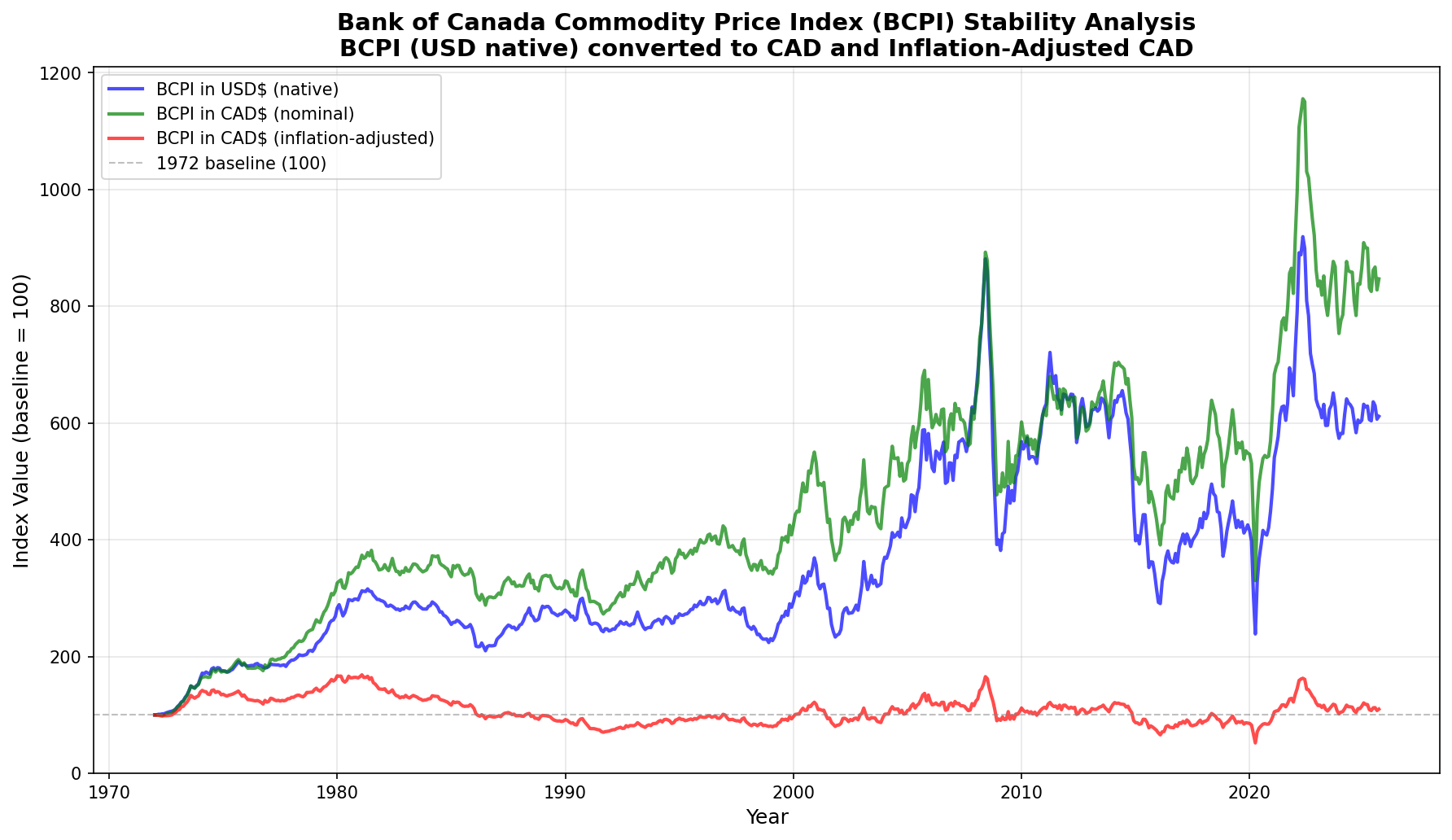

Canadian Labour vs. CAD$

The cost of labour is a major factor in all Canadian household expenditures and business enterprises, and should be included as one of the commodities defining the BUCK. This component represents the cost to hire the Canadians who turn the physical commodities into products and services people use. It would also indirectly represent the overhead costs (such as taxes) required to facilitate an economy, as labour costs are pre-tax; the higher the taxation, the greater the average hourly labour rate must be to counteract them.

Let's see how labour costs have matched CAD$ inflation for the period we have wage data for; 1997 - 2025. From 1972 - 1997, we don't have this data, but projecting from a reasonable average wage of $3.80/hr in 1972 (minimum wage was $1.90/hr, and average wages are roughly double minimum wage during most periods), we see 2 wage/inflation regimes; one from 1972 to 1997 where wage growth almost exactly matched CPI inflation, and then from 1997 to now, where wage growth "exceeded" inflation.

Other evidence seems to defy this claim of a labour income windfall over the last 2 generations. An alternative explanation could be that CPI inflation has been computed incorrectly (underestimated) since around 1997, and real wages have actually been stagnant since 1972…

Two explanations exist: either Canadian workers experienced an unprecedented 27-year windfall, or the CPI calculation change masked true inflation.

Sure enough; the Canadian CPI changed its method in 1995, from the Dutot to the Jevons formula 12. This muted the impact of rising prices by taking the geometric mean of all price changes, instead of the average change in all prices… However, we experience paying the average change in all prices. If food goes up by 10% and TVs go down by 10%, we haven't experienced 0% inflation!

This is spectacularly interesting. The rate of wage growth from 1972 to 1997 tracks CPI inflation almost exactly for 25 years; the average industrial wage was about $3.80/hr in 1972 (about twice the federal minimum wage of $1.90/hr). Then, magically, for the next 27 years from 1997 to 2024, wage growth suddenly changes its growth regime to uniformly exceed the CPI inflation annual growth rate of 2.16% by almost 50%, and grows by an annual rate of 3.06% per year!

Unbelievable? Yes, totally unbelievable. Because, by any measure, the real income and wealth of labourers has not grown by almost 50% more than the rate of inflation for 2 generations. Anyone who would make such a claim would be mocked by any numerate or sensate listener.

This inconsistency between labour income growth and inflation reality is perhaps better explained by the change in the definition of CPI inflation – not by sudden, inexplicable and simultaneous increases in natural wage growth across every industry:

Negative Effects of CPI Under-estimation

All external evidence points to a serious under-estimation of CPI to real costs, since the late 90's.

One of primary impacts of mis-representing CPI growth is that all Canadian tax rates are indexed to CPI. If your income rises by 41% relative to the CPI, your taxes paid don't go up by 41% (leaving you with the same proportion of after-tax income). Taxes increase "progressively" as your income increases vs. CPI.

For example, if you earn $100,000 and pay $30,000 (30%) in taxes and tax rates are indexed to a CPI of 2%, next year if you make $102,000 you'd expect to pay $30,600 (2% more) in taxes. Your net after-tax income grows from $70,000 to $71,400 – exactly 2% higher, exactly canceling out the 2% increase in the CPI – so your net income stays exactly the same, after inflation: If your wage growth exactly matches CPI.

However, let's say after the last 27 years, your income grew from $100K in 1997 to $225K in 2024 (as per the table above). However, tax rates indexed to CPI only shifted from $100K to $178K, so your last $47K of income is /now/ taxed in a /higher tax bracket/ than before. The sum of federal and provincial taxes would raise its tax rate by about 15%, costing your family an additional $7K of tax. Assuming no other tax increases in the intervening years, and your original tax bracket, your 30% tax rate on $225K would now have been about $67K, leaving $158K net.

The additional $7K of taxation increase due to under-estimation of CPI now costs you a full 5% of your net income. Every year. In addition to the increased cost of living experienced beyond the under-reported CPI inflation.

The claim that taxes have remained relatively stable in Canada over recent years neglects this fact.

The BUCK Commodity Basket

So, what commodity basket should an Alberta Buck be defined in terms of, so that it has the ability to accurately convey purchasing power from the present into the future? It must include the market prices of all the foundational input building-blocks of the civilization that broad money claims to provide the liquidity for, representing:

- Physical commodities; acquisition of base minerals, food, energy supplies

- Labour activity; provision of manufacturing and service expertise

- Logistical execution; industrial supply chains, personal mobility and last-mile delivery

- Bureaucratic overburden; taxation and regulatory costs required to satisfy productivity gate-keepers

All of these represent a portion of the cost of every good and service purchased by an Alberta Buck, and the value of the Buck should closely match the aggregate increase and decrease in all of these.

Ideally, the CPI basket should be a reasonable starting point, but (as we've seen), the CPI calculation has been adjusted to make it "less volatile", by representing the "average of price changes" instead of the "arithmetic mean prices". Something is terribly wrong, and it is not clear how to fix it. We've gone from a single wage earner being able to build a family and own a home up to the 90's, to multi-earner households having to visit the food bank to survive and give up the hope of ever owning a home.

In many jurisdictions, the entire younger generation has given up on the idea of productive effort being rewarded, and are embracing socialism and forced redistribution, accelerating the flight of entrepreneurs and the wealthy to less hostile pastures.

Alberta is, thankfully, still early in this cycle due to our industrious, entrepreneurial and relatively youthful populace. But, unless we act decisively to forge sound money that rewards prudence and the entrepreneurial spirit – we will ultimately be sucked into the vortex of Ottawa's economic death spiral.

The best we can do is a combination of the price of unvarnished, basic Industrial Commodities produced / used and priced in Alberta, and a reliable proxy for a broad base of industrial and service sector Employment Wages and Contract Incomes.

The market price of basic food, energy and industrial Commodities represents the feed-stock of civilization. The market price of labour represents both the capability to convert that feed-stock into wealth, but also the cost of the required bureaucratic overheads (taxes, licenses and fees) required to satisfy the gatekeepers (tragically, the single largest expense category for Canadian families, increasing from 33.5% in 1961 to 56.5% of income 13)

Some combination of these widely and regularly measured physical and labour commodities form the value-stable foundation of the Alberta Buck.

Why This Time Is Different: Lessons from History

Commodity-backed money is not a new idea. Gold and silver standards dominated global commerce for millennia, and various commodity-backed systems have been attempted throughout history. Most failed or were abandoned. What makes the Alberta Buck proposal different from these historical failures?

Historical Challenges of Commodity Money

Traditional Commodity money faced several fundamental problems:

- Single-commodity volatility: Gold and silver standards tied currency value to a single commodity whose price could swing dramatically due to new discoveries, production changes, or shifts in industrial demand. The California Gold Rush of 1849 and similar events caused severe monetary disruptions.

- Deflationary bias: Fixed commodity backing meant money supply couldn't expand with economic growth, creating chronic deflation that rewarded hoarding over productive investment and made debt repayment increasingly burdensome.

- Physical limitations: Transporting, storing, and verifying physical gold or silver was costly, slow, and vulnerable to theft or fraud. The "coincidence of wants" problem made direct commodity exchange impractical for most transactions.

- No automatic stabilization: When currency values diverged from economic fundamentals, no mechanism existed to automatically restore equilibrium beyond the slow, costly process of physically moving commodity reserves between jurisdictions.

Modern Solutions to Historical Problems

The Alberta Buck addresses each of these historical failures through modern technology and design:

- Commodity basket diversification: By defining value in terms of a basket of Canadian commodities plus labour, the BUCK avoids single-commodity volatility. No individual commodity price swing can destabilize the currency, as demonstrated by the BCPI stability analysis.

- Dynamic issuance: The

BUCK_KValue Stabilization Factor allows money supply to expand and contract with economic activity and commodity price changes, preventing both deflation and inflation. Unlike fixed gold standards, the system automatically adjusts to maintain stable purchasing power. - Digital settlement and verification: Blockchain technology enables instant, costless transfer of value anywhere in the world. Smart contracts automatically verify asset attestation and insurance status without requiring physical commodity movement. The "coincidence of wants" is solved through liquid DeFi pools where BUCKs can instantly exchange for other currencies or assets.

- Algorithmic price stability: Multiple independent Oracle controllers continuously monitor BUCK trading prices against commodity basket values and adjust issuance capacity in real-time, maintaining stability through automatic market operations rather than requiring central bank intervention or physical commodity transfers.

- Wealth backing vs. commodity redemption: Unlike historical systems requiring redemption of currency for physical commodities, BUCKs are backed by diverse wealth holdings with no requirement to maintain commodity reserves. An account holder's obligation is simply to redeem BUCKs when liquidating backing assets, not to exchange BUCKs for specific commodities on demand.

- Restoration of labour vs. capital balance: When direct wealth monetization is available, labourers will have the option to increase the value of their property or business and gain access to that increase in value immediately by issuing BUCKs. Presently, they only have the option to sell goods or services for income. This should restore a more equitable balance between labour and capital. 14

Why Now?

Three recent developments make wealth-backed money practical for the first time in history:

- Distributed ledger technology: Byzantine Fault Tolerant consensus and modern blockchain systems provide the secure, decentralized infrastructure necessary for trustless wealth attestation and money creation without requiring trusted intermediaries.

- Real-world asset tokenization: The explosion of RWA (Real World Asset) tokenization platforms and parametric insurance products provides the legal and technical framework for verifying and insuring diverse wealth types, from real estate to agricultural inventory to intellectual property.

- DeFi liquidity infrastructure: Decentralized finance pools and automated market makers enable instant, low-cost exchange between the BUCK and other currencies or assets, solving the liquidity and "coincidence of wants" problems that plagued historical Commodity money.

These technologies simply did not exist during previous Commodity money experiments. The combination makes possible what was previously impractical: a stable, wealth-backed currency that avoids the deflationary trap of fixed commodity standards while maintaining the value stability that fiat currencies have systematically failed to provide.

Debt-Issued vs. Wealth-Backed Money

Now that we've re-established the possibility of wealth-backed money (not that this was ever really in question, since this was the monetary standard for the vast bulk of human existence… ;) let's review some practical examples of how this works.

Current Debt-Based System

Under the existing system, money creation follows a perverse logic that enriches financial intermediaries at the expense of productive economy participants. When an Alberta farmer needs $500,000 to purchase equipment, the lending bank performs the following operations:

The bank creates a loan asset of $500,000 representing the farmer's promise to repay, and simultaneously creates a $500,000 deposit liability. No existing bank funds move, or become unavailable, or are otherwise "lent" out. The bank's balance sheet expands by the stroke of a pen.

The farmer, however, pledges real collateral – perhaps the farm itself – and contractually commits to "repaying" $68,000/yr at 6% APR annual interest, totaling $180,000 in interest payments over a 10-year term. If they fail to abide by the terms of the "loan", they lose the family farm!

The economic absurdity becomes clear when examining what each party contributes. The farmer provides genuine valuable consideration through collateral and productive labor to generate repayment capacity. The bank provides an accounting entry made possible solely by its regulatory exemption from Client Money Rules, as Werner6 documented. Yet the farmer pays $180,000 for this costless bank operation and risks losing the collateralized assets if unable to maintain payments.

Wealth-Backed Alternative

Consider the same farmer under a wealth-backed system. The farmer owns $1 million in land, equipment, and stored grain. Through a wealth "attestation" process similar to current property assessment and title insurance methods, these assets are verified and valued. The farmer can then create Alberta Bucks equivalent to 50% of the attested value -- $500,000 – while retaining full use and benefit of the assets.10

The critical difference emerges in the payment structure. Rather than paying interest to a bank, the farmer pays only insurance premiums to protect against asset loss; typically 0.5% to 1% annually for agricultural assets. On $500,000 in created money, this represents $2,500 to $5,000 yearly versus $30,000 1st year in bank interest. The $25,000+ annual difference remains in the farm operation, funding expansion, equipment modernization, or household consumption. Furthermore; there is no "principal repayment", so the net of the entire $68,000/yr payment stays in farm operations, or goes to reduce the BUCK lien on farm assets, at the farmers choice – there is never a risk of "default", and insurance covers the risk of loss of the backing collateral.

The balance sheet operations also differ fundamentally. The farmer's personal balance sheet shows an asset (the pledged wealth) and a liability (the obligation to redeem Alberta Bucks if selling the asset). The Buck monetary system shows the created Alberta Bucks backed by the attested wealth, and is the payee of the insurance in case of loss. No interest accumulates because no party provided funds that became unavailable – the money was created through wealth attestation, not borrowed from existing pools.

The Transition from Debt-Based to Wealth-Backed Money

Initially, all existing financial obligations continue in their current forms. A farmer issuing

BUCKs would immediately convert them via AMM pools and crypto/fiat exchanges to Fiat CAD$, USD$,

etc. to pay bills, equipment costs, and insurance premiums – exactly as today. Asset insurance is

initially a standard insurance contract payable to the BUCK smart contract to destroy any BUCKs

issued on the pledged asset, should the collateral be destroyed or lost. Parametric insurance

components (such as account default insurance) are built into the BUCK ERC20.mint smart contract

and paid as a proportion of BUCKs issued.

Over time, as BUCK liquidity deepens through repeated issuance and exchange cycles, vendors and buyers begin quoting goods and services directly in BUCKs. This organic transition reduces demand for CAD$ in trade. As wealth-backed BUCKs progressively displace debt-based money, and as debts are retired without replacement issuance, the mathematics of debt-based systems – which require ever-increasing money supply to service interest – eventually force a reckoning. The transition to wealth-backed money provides an orderly path forward when that moment arrives.

Household Impact: Debt Bondage to Wealth Management

For all but the top few percent of households, the greatest emotional and mental burden is attempting to stave off bankruptcy. Food bank usage has doubled since 2019, increasing over 5% year over year. In 2025, almost 20% of food bank clients report being employed, almost double the 12% reported in 2019.

A large proportion of this financial insecurity comes from the burden of debt-issued money.

Mortgage Debt

Alberta households currently carry $197 billion in mortgage debt, with the average mortgage standing at $380,000. Under conventional financing at current rates around 5.0%, a family pays approximately $19,000 annually in interest during the first years of their mortgage. Over a 25-year amortization, they will pay roughly $286,433 in interest on top of the $380,000 principal, meaning they effectively purchase their home 1.75 times.

Under wealth-backed money creation, the same family would verify their home's ownership and value and create Alberta Bucks to purchase it outright15. They would pay annual insurance costs of perhaps 0.5% (given the stability of residential real estate), or $1,900 yearly. The obligation would be to redeem the Alberta Bucks if selling the home, but no interest would accumulate during ownership. The family saves $17,000+ annually, funds that can support local consumption, education investment, or business formation.

The macroeconomic implications multiply across Alberta's 580,000 mortgaged households. If even half transition to wealth-backed financing, the province retains $5.8 billion annually that currently flows to financial institutions. This money recirculates through local economies, supporting retail businesses, services, and employment rather than enriching distant shareholders.

Vehicle Financing

Alberta households also carry approximately $12 billion in vehicle debt, paying roughly $600 million annually in auto loan interest. The average vehicle loan of $35,000 at 7% interest costs $2,450 yearly in interest payments. Under wealth-backed creation, a family could attest their vehicle's value and create Alberta Bucks without interest obligations.

The transformation becomes more powerful when considering that vehicles are depreciating assets. Under debt financing, families pay interest on a declining value; a form of double loss. Under wealth-backed creation, the obligation to redeem simply tracks the declining asset value, with no interest penalty compounding the depreciation impact. A family might pay $1,000 annually in insurance premiums instead of $1,000 in insurance plus $2,450 in interest, freeing up the $2,450 yearly for productive uses.16

Business Impact: Probable Failure to Productive Investment

Businesses often have the burden of carrying large stocks of illiquid assets and receivables and have fixed liabilities, often to the government (eg. payroll taxes), with no way to monetize them except through private lenders at high market interest rates. Banks are unwilling and frankly unable to "lend" (issue) flexibly simply due to the complexity of valuation and insurance of this dynamic asset base17.

Agricultural Sector

Alberta's agricultural sector demonstrates the crushing weight of debt-based finance most starkly. The province's farms carry $37.4 billion in debt, with average interest costs consuming a third of the $5.7 billion in Alberta's farm cash income. Many operations exist primarily to service debt rather than generate prosperity for farming families and their communities.18 19

Consider a mid-sized grain operation with $3 million in land, $1 million in equipment, and typically $500,000 in stored grain inventory. Under current financing, this farm might carry $2 million in debt at 5% interest paying $100,000 annually to banks. In low commodity price years, this interest burden often exceeds operating profits, forcing farmers to borrow more simply to service existing debt; a vicious cycle that has driven countless families from agriculture.

Under wealth-backed creation, the same farm could attest its $4.5 million in assets and create Alberta Bucks up to perhaps $2.25 million (at a conservative 50% ratio). Annual insurance costs might total $15,000 for the diversified asset base. The farm saves $85,000 yearly, transforming marginally viable operations into profitable enterprises. This difference enables equipment modernization, sustainable practice adoption, and succession planning that debt servicing currently prevents.

The stored grain inventory presents particularly compelling opportunities. Farmers currently face a cruel choice: sell grain immediately after harvest when prices are lowest to service debt, or finance storage costs at interest while hoping for price improvement. With wealth-backed creation, farmers could attest stored grain value, create Alberta Bucks for immediate needs, and redeem those units when selling at optimal prices. This breaks the debt-driven cycle that forces farmers to accept unfavorable prices, improving both farm income and market price stability.

Most importantly: the family farm is never at risk of default, stanching the haemorrhaging of our citizens' farms (acquired by banks through the pretense of "loan" default) to multinational industrial farming operators.

Small Business

Alberta's 170,000 small businesses collectively carry over $40 billion in debt, with interest costs representing a major barrier to growth and innovation. A typical small manufacturer with $2 million in equipment and $500,000 in inventory might pay $125,000 annually servicing debt; often exceeding the owner's salary.

Under wealth-backed creation, the same business could attest its equipment and inventory, creating Alberta Bucks for working capital without interest obligations. Insurance costs of perhaps $10,000 annually replace $125,000 in interest payments. The $115,000 difference funds hiring, research and development, or market expansion that debt servicing currently prevents.

The transformative potential extends beyond cost savings. Currently, banks prefer lending against real estate rather than productive assets, forcing businesses to leverage personal homes for commercial credit. Wealth-backed creation values productive assets directly: manufacturing equipment, inventory, intellectual property; aligning capital creation with productive capacity rather than real estate speculation.

Provincial Economics: Servitude to Sovereignty

The average Canadian citizen pays about $2,000 per year in public debt service costs. That's about $8,000 annually for a 4-person family; over 10% of the average gross $74,200 family income.20 21

When a population loses control of a significant fraction of its income to service "public debt", this necessarily pushes aside other significant purchases and investments. Public debt service costs and taxation are by far the largest costs Canadian families pay 22, and even so are clearly inadequate to support the seething, overshadowing bulk of government, since governments at every level are running record-braking deficits.

What can be done?

Once one realizes that this public "debt" is actually risk-free broad money issuance by commercial banks backed by claims on government assets and future revenue – simply the price paid to banks to issue our money into existence on force buying of public "debt" notes – some alternatives become clear.

These national burdens fall particularly heavily on Alberta, which has both the wealth and the jurisdictional autonomy to forge an alternative path. Let's examine what Alberta could do.

Reduced Public Debt Servicing

Alberta currently allocates $3.2 billion annually to debt servicing; funds extracted from public services and infrastructure investment. This represents $700 per Albertan 23 yearly, or $2,800 for a family of four, transferred to bond-holders rather than invested in provincial development.

Under wealth-backed Alberta Buck creation, Alberta could monetize its vast public assets without debt obligations. The Heritage Savings Trust Fund's $30 billion value alone could back substantial Alberta Buck creation. Crown lands valued at over $100 billion provide additional backing capacity. Resource royalty streams, worth $21 billion annually, offer further monetization potential without debt accumulation.

The province could fund a decade-long infrastructure modernization program by creating Alberta Bucks backed by the very infrastructure being built. A $50 billion program for schools, hospitals, and renewable energy would typically cost $75 billion including interest over 20 years. Through wealth-backed creation, Alberta pays only the actual $50 billion construction cost plus modest insurance premiums, saving $25 billion that remains available for additional public investment.

Resource Revenue Optimization

Alberta's resource wealth currently generates provincial revenue through royalties and taxes, but the full value potential remains uncaptured. The province's revenue share of proven oil reserves, valued conservatively at $2 trillion, could back massive Alberta Buck creation for sovereign wealth fund expansion, economic diversification, and citizen dividends.

Instead of borrowing against future resource revenues at interest, Alberta could create money backed by it's claim on proven reserves, invest those funds productively, and redeem the units as resources are extracted. This transforms resources from a depleting inheritance into a perpetual prosperity engine, as investment returns compound while redemption obligations remain fixed.

The Need For Urgency

Stablecoins backed by USD debt instruments are exploding in use globally24.

Simultaneously, the Government of Canada is restricting access to crypto technology25, preventing similar CAD based instruments, and crippling CAD denominated projects and jurisdictions by restricting them from benefiting from the improvements in operational efficiency and access to funding provided by these technologies.

Alberta is uniquely positioned to establish itself as a global leader in this field, by offering the world's first Stablecoin backed by a stable, secure and unencumbered basket of valuable commodities, instead of volatile and risky foreign debt instruments.

To accomplish this, Alberta must immediately initiate a comprehensive research and development program to prototype wealth-backed money creation systems. The technical foundation exists through recently discovered failure-resilient distributed ledger technologies and established asset insurance and attestation methods and constitutionally protected legal remedies, but integration and testing require dedicated resources and expertise.

We have home-grown Alberta talent with a proven track record of building continent-spanning industrial automation. It is time to apply this Alberta Advantage to the next generation of wealth expanding technology: Wealth-backed instead of Debt-backed Stablecoins.

Provincial Jurisdiction and Constitutional Authority

Federal monetary authority in Canada is well-established under the Constitution Act. However, the Alberta Buck operates within provincial jurisdiction over property, contract, and civil rights. The BUCK is not "legal tender" competing with the Canadian dollar, but rather a digital commodity token representing attested wealth claims – similar to how gold certificates or grain elevator receipts have historically circulated without federal monetary authorization.

Provincial authority extends to: regulating insurance products and asset attestation within Alberta; enforcing contracts and property liens under provincial law; and facilitating private tokenization of real-world assets. The federal government regulates currency issuance and legal tender, but cannot prevent private parties from creating and exchanging value tokens any more than it can prevent barter, precious metal transactions, or cryptocurrency holdings.

The Alberta Buck's legal foundation rests on constitutionally protected private contract rights, established insurance and property law, and the voluntary choice of parties to transact using BUCKs rather than CAD$. This approach avoids direct confrontation with federal monetary authority while exercising legitimate provincial jurisdiction over wealth attestation and contractual relationships.

For detailed analysis of constitutional constraints, regulatory gaps, and other legal objections, see Addressing Common Objections. A much more detailed Alberta Buck - Legal Foundation (DRAFT) is also a work in progress.

Prototype Development Requirements

The prototype system must demonstrate several critical capabilities.

Asset attestation mechanisms must accurately value diverse wealth types from real estate to agricultural inventory while preventing fraud and double-pledging; the insurance industry already has expertise in this, and applying it to tokenized RWAs is actively being researched.

The distributed ledger must process transactions at commercial speeds while maintaining security and auditability; recent breakthroughs in Byzantine Fault Tolerance and CAP theory resilient distributed systems show this is possible.

Integration with existing payment systems must be seamless to encourage adoption; Stablecoin adoption illustrates this is possible. Regulatory frameworks must ensure compliance while preserving system benefits; we can and must do much better than banks at this, and methods are available to both preserve privacy while empowering law enforcement to capture offenders.

A one-year, $6 million R&D program could deliver a functional initial pilot program. This investment would be recouped within months through reduced debt servicing costs once operational. Delay, however, costs Alberta $23 billion /annually/ in unnecessary interest payments: over $63 million daily transferred from productive economy to financial intermediaries.

The cost/benefit ratios are compelling: for roughly 10% of the current daily losses paid to intermediaries, Alberta could position itself to have a globally unique offering: proven expertise in Wealth-backed Stablecoin technology, implementation and adoption.

Albertans could begin seeing economic benefits within 1 or 2 years. Within 2 or 3 years, global demand for secure Stablecoins to underpin corporate and government treasuries could create demand for Alberta Bucks far beyond even domestic usage. There is a real possibility that Alberta's vast commodity, energy and farming wealth could become a global reserve asset – if we choose to make it available to the world!

Pilot Program Opportunities

Strategic pilot implementations could demonstrate system viability while generating immediate benefits. Agricultural communities facing acute debt stress present ideal initial deployment opportunities. A pilot program focused on Alberta family farming operations could enable farmers to attest grain inventories and equipment, creating Alberta Bucks for operational expenses while retaining assets for production.

Small business districts in Calgary, Edmonton or Grande Prairie could pilot commercial applications, enabling businesses to monetize inventory and equipment for working capital without interest obligations. The immediate cash flow improvement would benefit many small businesses while identifying areas needing refinements.

Municipal governments could pilot infrastructure financing through wealth-backed Buck creation, funding community projects by attesting public assets rather than issuing interest-bearing bonds. A single $100 million municipal infrastructure program could save $50 million in interest costs over 20 years, providing compelling evidence for provincial-scale adoption.

Scaling to Provincial Implementation

Following successful pilots, provincial implementation requires coordinated development across multiple fronts. Legislative frameworks must establish asset attestation standards, insurance requirements, and redemption procedures. Technical infrastructure must scale to support millions of users and billions in transaction volume. Educational programs must help Albertans understand and utilize the new system effectively.

The implementation timeline could achieve meaningful impact within 2-3 years. Year one focuses on R&D and prototype development. Year two implements agricultural and small business pilots. Year three expands to municipal government participation. Year four enables broad consumer adoption for mortgages and vehicle financing. Year five achieves full provincial integration including government finance transformation.

With urgent concerted effort and focus, however, Alberta could implement this project on a much more rapid time frame. The cryptographic and distributed system tools are now available to build a prototype that is usable by technically savvy, willing, private communities of crypto-friendly asset holders. The legal frameworks exist to create private asset-backed tokens that represent attested (verified and insured) wealth ownership, and the constitutionally protected private contractual guarantees, liens and other legal remedies required to implement the necessary insurance tools are regularly exercised and sound.

Alberta can rise to this challenge, and summon the will, effort and funding to achieve rapid prototyping, testing and operation. We Albertans understand complex obstacles, set ambitious goals, and then get things done.

Conclusion: Alberta's Historic Opportunity

Alberta stands at a pivotal moment where technological capability, economic necessity, and political possibility converge to enable fundamental monetary reform. The province currently haemorrhages $23 billion annually in interest payments that extract value without providing corresponding benefit. This represents the province's entire health care budget, or sufficient funds to eliminate provincial income tax while still having billions available for infrastructure investment.

The transition from debt-based to wealth-backed money creation would transform every aspect of Alberta's economy. Families would retain thousands annually currently lost to mortgage and loan interest. Farmers would escape the debt trap that forces agricultural consolidation and rural depopulation. Businesses would access capital based on productive capacity rather than real estate collateral. Government would fund development through wealth attestation rather than debt accumulation.

The technical mechanisms exist. The legal foundation is sound. The economic benefits are quantifiable and massive. What remains is the political will to challenge entrenched financial interests and implement systems serving Albertans rather than extracting from them.

Every day of delay costs Alberta $63 million in unnecessary interest payments. Every year of inaction transfers $23 billion from productive economy to financial intermediaries. The government's responsibility to pursue this transformation is not merely important: it is morally urgent, financially essential, and historically important. Alberta must act now to prototype, prove, and implement wealth-backed money creation, or condemn future generations to perpetual debt servitude when liberation lies within reach.

The choice is stark: continue enriching distant financial institutions through interest payments and claims on citizens' assets, on money they create from nothing, or enable Albertans to create money backed by their own real wealth while retaining its value within provincial communities. The moral, economic, and practical arguments align unequivocally: Alberta can pioneer wealth-backed money issuance to secure its economic sovereignty and prosperity, or follow the rest of the world down a dark path.

Footnotes

Global debt $335T, 2025

Global GDP $106T, 2023

Money in the Modern Economy Bank of England, 2014, pp11

Misunderstanding Flight 2023 Bernoulli or Coanda effect? Neither, as it turns out…

How do banks create money… Werner, Richard A., International Review of Financial Analysis, 2014.

Alberta 2025-28 Fiscal Plan Alberta Budget 2025

Simplified model assumes no equity capital requirements or reserve costs; in reality, banks' advantage is reduced but persists due to low-cost deposit funding and maturity transformation.

While 'seigniorage' classically refers to central bank profits from base money issuance, economists (e.g., in post-Keynesian analyses) extend it to banks' extra profits from creating deposit money at low funding cost.

Wealth Coin: A dynamic Credit Factor 'K' is computed which maintains a zero inflation rate.

If they have a 50% downpayment; otherwise a small mortgage balance remains, which they can quickly pay off.

Essentially, every vehicle "loan" becomes a lease of the net depreciation, slowly moving buyers to purchase higher quality assets with slower depreciation curves.

Only a decentralized asset attestation and insurance system (which scales with user base) can address this.

Fraser Institute: Canadian public debt interest cost ~ $2,000/person in 2025

StatsCan: Average after-tax income 2023 ~ $74,200 in 2023

Fraser Institute: Taxes largest family cost 2024 ~ $48,306 of avg $114,289 gross income

Visa Onchain Analytics, Stablecoin usage growing globally

The 2025 federal budget promises they will start thinking about maybe supporting Stablecoins, but if the present BoE proposals are any guide, their legislation will be a hindrance, not a help.