A quite mathematically detailed and negative critique of Canadian Universal Life Insurance programs. PDF (original)

Why this matters

Here is the math behind why Canadian UL life insurance policies (known as VUL in the United States) do not work effectively as a "tax shelter". It is your responsibility as a financial "professional" to understand these concepts, and to assist owners of such policies to understand them, too! Remember, Canada is a free country; it's just fine for a client to choose to purchase any investment they wish, based on full and truthful disclosure. However, it is fraudulent to imply that an inferior investment is actually superior, and thus cause the client to make an incorrect choice! This is what is wrong with selling UL policies as an investment, a "tax shelter", a "Leveraged or Insured Retirement Plan", or even as "term insurance with a savings plan". It is simple to show that UL policies with certain types of extra fees cannot outperform a separate term policy + the identical investment. Their internal cost structures simply do not allow them to! To imply otherwise is to perpetrate a fraud. This particular word was very carefully chosen:

fraud (frôd) n.

- A deception deliberately practiced in order to secure unfair or unlawful gain.

- A piece of trickery; a trick.

- One that defrauds; a cheat.

- One who assumes a false pose; an imposter.

Of course, the following explanations depend on the client (and insurance agent) wanting to, and being able to read and understand their own contract. If a client purchases the product based completely on trust, and has no desire to read and understand where their money is going, then there is nothing that can be done to help them! It doesn't change the fact that the agent is responsible to tell them the whole truth in the first place; there just may not be anything you can do to help them…

Two General Classes of Fees

There are two broad classes of fees in most Universal Life policies; fixed up-front fees due to insurance costs, policy fees, and premium tax based on the amount of insurance purchased or the amount of money invested that year, and compounding annual fees on the growing investment amount within the policy. The fixed up-front fees are very similar to those found in most term insurance policies, so can be factored out of most comparisons of UL vs. BTID (Buy Term and Invest the Difference), because the same amount of money can purchase the same amount of insurance from the same company, either within the UL, or outside the UL program in the form of term insurance.

Up-Front Fees: Well Disclosed…

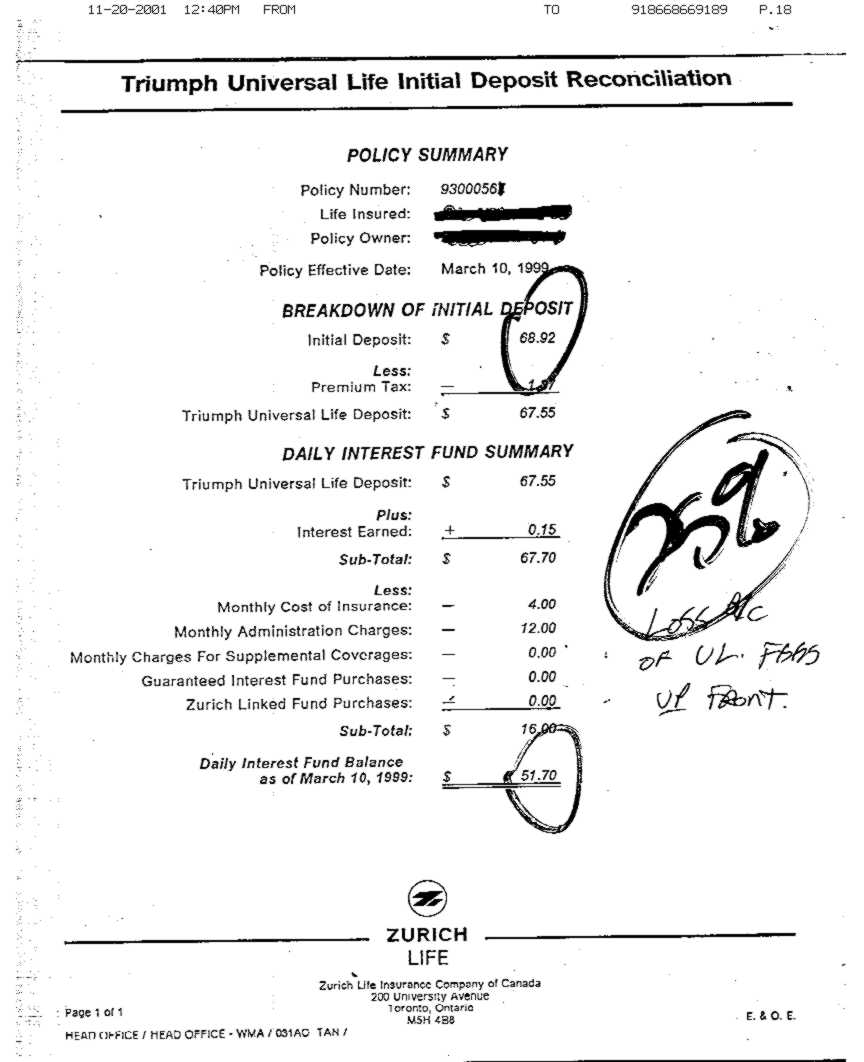

In fact, the additional 2% premium tax on the total deposits into UL policies generally allows more term insurance to be purchased outside the UL, for the same amount of money (because the portion going to savings outside a UL policy isn't subject to this tax). Even though the up-front fees are large, especially when the program is sold primarily as a tax-deferring investment rather than insurance (such as for this Universal Life Insurance "education savings plan" on a child, above), they are minor compared to the long term damage inflicted by the other type of fees. These up-front flat fees are well disclosed in UL projections.

Compounding Fees: Not so much…

The excessive compounding annual fees (MERs) are the primary source of problems in UL programs, and are not disclosed diligently in most projections, and are misrepresented in those that disclose them at all! Typically from 2.5%/year (Zurich Life) to 6%/year (Standard Life Perspecta) gross (before bonuses give a portion back), these extra fees on the compounding investment account essential destroy any UL program's ability to preserve a client's estate, over any long period of time.

Since UL programs only work if maintained until death (the only point where the savings are paid out as a tax-free death benefit), the time periods are typically quite long (~35 years life expectancy for a 50 year old client).

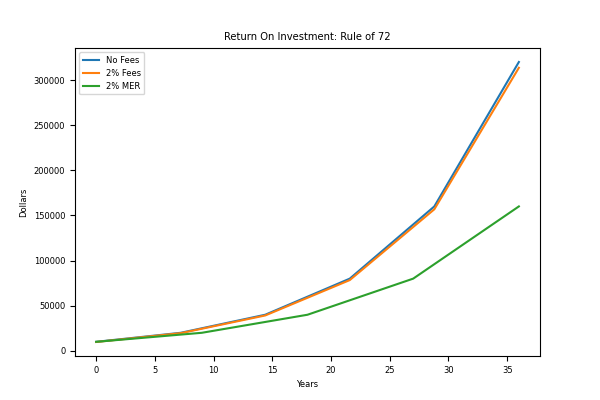

The impact of an excess annual compounding fee can be estimated by using the rule of 72; if the net after-bonus extra fee is 2%/year, then the client will have half the assets after 36 years, as compared to the identical investment in an open investment account! If the net after-bonus extra fee is 3%/year, then the client will have about half the money in 24 years! These excess MER fees vastly outweigh any other fee the UL policy could charge (except in extreme circumstances). Here is an example of the difference in impact between a 2% up-front extra fee, and a 2% compounding annual fee, over 36 years:

| Fee Type: | Year | No Fee | Year | 2% Fee | Year | 2% MER |

|---|---|---|---|---|---|---|

| Net Return: | 10.0% | 10.0% | 8.0% | |||

| Doubles in yrs: | – | 7.2 | – | 7.2 years | – | 9.0 years |

| Initial Deposit: | 0 | $10,000 | 0 | $9,800 | 0 | $10,000 |

| (1st doubling) | 7 | $20,000 | 7 | $19,600 | 9 | $20,000 |

| (2nd) | 14 | $40,000 | 14 | $39,200 | 18 | $40,000 |

| (3rd) | 22 | $80,000 | 22 | $78,400 | 27 | $80,000 |

| (4th) | 29 | $160,000 | 29 | $156,800 | 36 | $160,000 |

| (5th) | 36 | $320,000 | 36 | $313,600 |

Now, of these two classes of fees, which do you think is the most important for the client to be well informed of? So, why are the up-front fees disclosed diligently, but the disclosure of excess net annual compounding fees (MER) is incorrect, or completely absent, and no one in the industry or regulatory body seems interested in challenging this? Perhaps the "goals and objectives" of the average UL client would suddenly change, when it is disclosed that they would lose half their assets over 36 years?

Since the exact same amount and type of life insurance is being purchased outside the UL policy, using the same amount of money, and the maximum tax rate on capital gains is 19.5% in Alberta, it follows that the client will A) have roughly double the money in the non-UL plan after 36 years, compounding at 2% greater annual ROR (Rate of Return) to draw income from during retirement, and B) the net after-tax combined death benefit of the non-UL plan will be greater at death, whether death occurs the day following the first premium payment, or at age 100.

In fact, the greater the amount of money invested in the UL program, and the longer the program exists, the more it reduces the total after-tax net benefit to the client! The idea of "ideal high net worth UL clients" is a sham! The only one who benefits more from an "ideal" client, is the agent!

The Key: The "rule of 72", and ~2%/year Excess Expenses

The key to understanding most current UL policies is very, very simple; the "rule of 72", and a SINGLE DIGIT found buried within the reams of legalese of the policy – the extra annual MER of the underlying investment.

To decrease the likelihood of discovery, this digit is not actually just plainly disclosed; you have to figure out the formula to discover it! Remember, although the other up-front fees (premium tax, administration fees, etc.) will cost the client thousands or even hundreds of thousands of dollars over the life of the contract (each $150/yr in admin fees and premium taxes costs $4,400 in 36 years at 10%), these costs are virtually insignificant compared to the effect of the unnecessary extra annual MERs that the UL adds onto the underlying investment. The fixed costs of the policy are also meticulously and verbosely disclosed, and serve mainly to distract the client from the true messenger of their financial doom; these extraordinarily high MERs will over time literally cut the total value of the investment to HALF of what it would be in the identical investment held outside the UL policy!

So much for tax benefit!! You certainly will pay less tax, after you lose half of your investment! Here's how it works:

Extra MERs

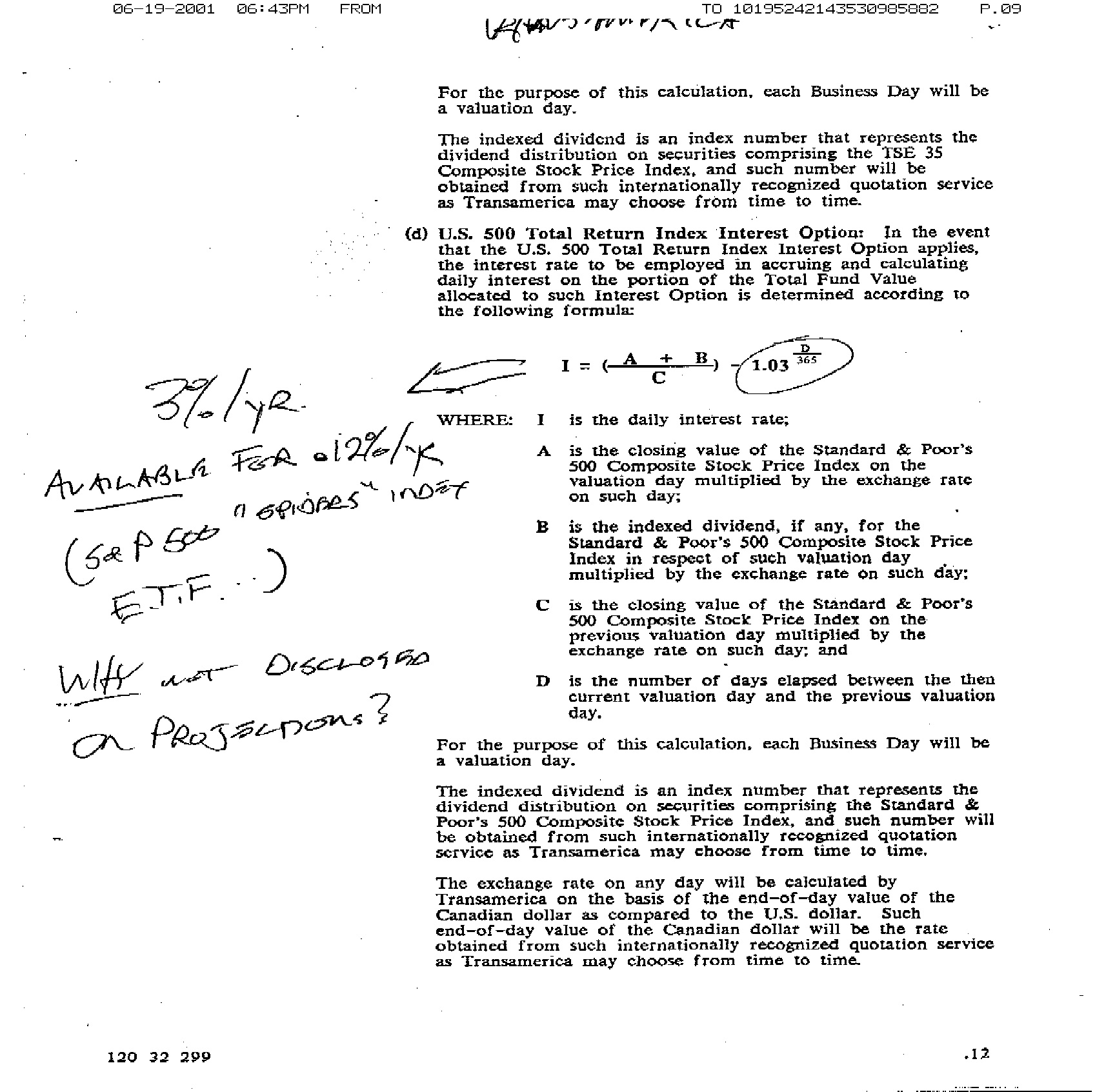

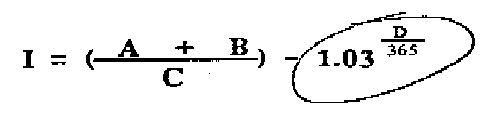

In the Transamerica policies, the underlying investments include index funds of various types; TSE, S&P 500, etc. The ones most likely to be used as a long-term investment are the stock market index funds. If you look at the S&P 500 index fund calculation, there is a rather complex looking formula that says (after you decode it) that the MER on this policy's S&P 500 index fund is 3.00% per year. Sometimes they're just straight up bold about it, though:

Now, this is fine – as long as you don't realize that you can obtain the identical investment outside of this UL policy for about 0.1% per year. (Yes, you read that right: 12/100ths of a percent per year, on the "SPIDERS" Exchange Traded Fund, "SPY"!, or the iShares S&P 500 ETF "IVV" at 0.09% per year.) If you don't want to buy a stock market traded (ETF) index fund, then you can find a normal index fund, at a slightly higher fee – the average of all Canadian stock market index funds listed on globefund.com as of December 2000 was 0.50% per year – a full 2.50% per year LESS than you are paying inside the UL policy! I can't figure out a way to determine how many Canadians participate in foreign stock markets directly, through ETF's versus index funds, but it is probably a similar ratio. Now, the whole-life insurance agent is going to say "but, I'm not licensed to sell them an ETF!" and they're right. However, since when did it become an excuse not to not DISCLOSE a client's options, just because you aren't licensed? Doesn't one decide first what the right thing is to do, and then obtain the appropriate licensing to do that? If you have decided, as a professional, that "I believe stock market indexes are my client's best option.", then wouldn't you get the licenses that allow you to give your clients those indexes without ruining them financially?

Composite Price versus Total Return

Another way that UL policies surreptitiously charge large annual fees on the underlying investment is by using the Composite or Price index, versus the Total Return index. An example is the Zurich Life Agility III policy:

If you look at the historical returns of the TSE-300 index (which has generally been replaced by the S&P/TSX indexes; here is the difference between the Composite and a Total Return indexes); the difference is that the Total Return index includes the dividends, while the Composite doesn't. Over the last 15 years of the 20th century (a long period, representative of the amount of time someone would be investing in a UL program), investing in the TSE-300 the loss would be about 2.7%/year (5.6% ROR vs. 8.32% ROR over the 15 years ending October 31, 2001). Add on an additional 1%/year for good measure, and you've lost 3.7%/year in compound return over the last 15 years! Since the average MER on all index funds owned in Canada is about 0.5%/year, this is an excess cost of 3.2%/year just to own the TSE-300 index inside this UL policy, and you that would cost you about half of your assets in just 24 years! What client would knowing have "goals and objectives'' involving knowingly losing half of their assets in 24 years, or having one quarter of the money they could have had (in the identical investment, remember) at retirement in 48 years? That seems like financial suicide to me…

Compounding Daily Fees

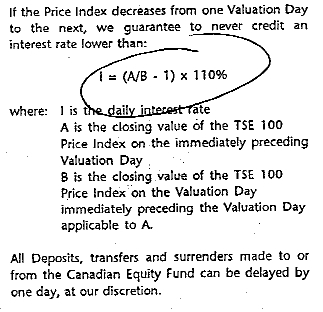

The most stunning example of extra UL fee abuse that I've seen is definitely the Standard Life Perspecta policy.

This equation works out to be ~6%/year in extra fees to own the TSE-100 index! Here's the way they hid the math. First, they calculate returns on a "valuation day'' basis; there are about 250 days/year that the TSE is open. So, if the TSE-100 averages 12% gross return, then the average daily return (A/B in the equation) works out to ~0.048%/day. They take 10% of these daily returns, or 0.0048%/day in fees. However, to annualize this return, you have to compound it by the 250 valuation days in the year, and it works out to a minimum of 3.31%/year MER on a 12% gross return (assuming that the TSE 100 returns its 12% absolutely linearly, which of course is not true; the actual fees would be worse, because of the large daily fluctuations).

On top of that, they take the "TSE 100 Price Index'', which excludes dividends! Now, the TSE-300 has returned ~2.7%/year in dividends over the last 15 years; the TSE-100 is probably higher (since it is composed of the top 100 largest and most profitable companies, vs. the top 300 largest…). Since the TSE 100 and 300 indices have been replaced, we can see a shorter time-frame illustration of this effect with the S&P/TSX Price and Total Return indices.

So, the extra fees works out to 3.3% + 2.7% = 6%/year in fees! Thus, since you can obtain the average Canadian index for ~1%/year in total costs (including fees plus annual taxation of dividends and crystalised capital gains; see below), you are paying an extra 5%/year over what the average Canadian who owned index funds paid. Lets say the UL company returns 2%/year back to you in bonuses (wildly optimistic); this still leaves 3%/year net excess fees, thus costing the client half their assets in ~24 years. Three quarters (3⁄4!) of their assets consumed in 48 years! Obviously, no client would knowing opt for such a product if it was fully disclosed, would they? So, why isn't the Alberta Insurance Council, which purports to extol the virtues of "full disclosure", not interested in forcing the thousands of agents who propose this product using policy projections to practice full disclosure? In fact, the policy projection sheets used to illustrate the product show the exact opposite of the math within the policy document; that the investment portion of this UL product, with its extra fees, will actually outperform the same investment outside the UL account!! How is that possible? Supposedly, by returning you a small portion of the extra fees in the form of a bonus!?!

MERs on Professionally Managed Investments

It is obvious that MERs make a huge difference in the long term returns of an investment account. How, then, can one rationalize using Mutual Funds or Segregated Funds (with an average of 2.5%/year in MERs), instead of Index Funds or ETFs (with an average of 0.5%/year in MER)? Using the same logic as above, the 2%/year greater fees on the Funds is guaranteed to cut their total returns in half compared to the Indexes over 36 years, right?

Not so. There is a difference between an MER that is used to purchase something of value (ie. the services of a professional investment manager), vs. an MER that is a pure fee (adding no value to the underlying investment). Over the longest bull- market run in history (the decade of the 90's), it became popular to discredit the value of professional fund management; Indexes seemed to universally outperform Funds, because every stock seemed to be an "up" escalator; clearly, if everything is going up, then the extra 2%/year in fees serves only to reduce your returns. Now, after experiencing the first truly turbulent markets in a decade, (where a large fraction of the stocks in the Index funds switched from the "up" escalator to "down"), many professionally managed Funds have returned their owners much more than the extra 2%/year in management fees, in the form of excess returns in relation to the Indexes the Funds are compared against, and lower volatility. Simply put, a 2.5% MER on a professionally managed mutual fund is incomparable to a 2.5% MER on an index fund. The fee on the index is guaranteed to reduce the total returns by 1⁄2 in 36 years. The fee on the mutual fund is purchasing expertise (presumably) that will return more than it costs, in the form of excess returns, reduced volatility, etc.

By the way, you'll note that professionally managed investment funds are much closer to each other in their MERs; if you've chosen professionally managed investments as your client's best option, then it makes little difference whether they get them through you, a no-load fund dealer, or by themselves through a discount broker (assuming, of course that they can figure out which funds best fit their risk/return horizon…) And, after the "dot-bomb" blowout, many people are (finally) realizing the wisdom of having a professional select their equities, rather than just "shot-gunning" the stock market, and picking the 35, 100 or 500 biggest! There is a great difference between taking 2.5%/year for adding no management value (eg. A 3% index fund, available elsewhere at 0.5%), versus investing 2.5%/year to have Charles Brandes, Martin Hubbes, Steve Rogers, or Richard Driehaus manage your portfolio!

The Cost of Losing ~2%/year in Extra Annual MERs

Here is yet another example of how we arrived at the numbers above, to illustrate again how the fees in UL and non-UL programs differ. After you account for dividends (see below) and some capital gains due to portfolio turnover in the index, which will generate a small taxation each year on the yield of the index fund, you are still looking at a cost of a solid 2.00%/ year in extra gross MERs, to enjoy the "tax benefits" of the UL. So, lets see what they are: We whip out our handy-dandy "rule of 72", and do some quick calculations (apparently, this is where we lose the average whole-life insurance salesman in complete confusion…)

| UL (-3% MER) | Non-UL (-1% costs) | |||

|---|---|---|---|---|

| S&P-500 Yield | 11% | 11% | ||

| Net Yield | 8% | 10% | ||

| 72 / Interest | ~9 years to double | ~7.2 years to double | ||

| Year, Value | 0 | $10,000 | 0 | $10,000 |

| 9 | $20,000 | 7 | $$20,000 | |

| 18 | $40,000 | 14 | $40,000 | |

| 27 | $80,000 | 22 | $80,000 | |

| 36 | $160,000 | 29 | $160,000 | |

| 36 | $320,000 |

Oops! One less doubling every 36 years, due to the loss of 2% return (rule of thumb: 72 / (extra % MER) == # of years until you have half the money!) So, you have half the money in your investment, after the average investing life span of the product (remember, this is being used as a retirement product! The bulk of the money will be in this policy for both the investing time span PLUS the retirement time span!) So, what are the "tax shelter" benefits of UL? Oh, yes; if you lose half your money, you'll get to pay less tax. Right…

So, what are the arguments that are commonly used to sell UL policies? Here are the major ones:

If you DIE, the investment is paid out TAX-FREE…

As an insurance death benefit!

Correct. Lets see if this benefit outweighs the cost of losing half of your investment over 36 years. Beginning with the results from investing in the UL vs. NON-UL plans for 36 years, from the table above, lets see what would happen if you died, and your estate had to pay all the taxes on your investment portfolio:

| UL | Non-UL | |

|---|---|---|

| Gross Yield | $160,000 | $320,000 |

| - Principal | N/A | $10,000 |

| = Capital Gain | N/A | $310,000 |

| x 50% = Taxable Gain | N/A | $155,000 |

| x 39% = Tax Owing | N/A | -$60,500 |

| = Net Benefit: | $160,000 | $259,500 |

Nope. So, on a single $10,000 invested into a UL policy, the "tax benefit" is an net after-tax loss of $99,500 to the client, at death, after 36 years!! In fact, if you do the math, it is a simple to see that usually immediately, and worst-case after just 1 or 2 years, the UL policy's stunted compounding leaves it panting in the dust!

Here is a spreadsheet where you can enter any combination of Rate of Return, extra UL MER, tax rates, etc, and see their effect on the UL account, compared to an open investment account and a RRSP account. The differences are utterly staggering, and any client who had access to this spreadsheet would be stunned that their agent actually tried to sell them the UL program! Unfortunately, it is unlikely that any agent would want to disclose these calculations to their clients; perhaps because they would cause their clients to alter their "goals and objectives" to not include losing half their money!

Dear whole-life insurance agent; I'm sorry if you don't understand this. It doesn't change the fact you've been systematically and thoroughly lied to, and as a result have been assisting in the defrauding of your clients. It probably isn't even your fault.

Before you die, the investment grows tax-deferred…

As long as it continues to be considered an "exempt" insurance product.

Wonderful, lets see:

To be considered "exempt", it must be primarily an insurance product, rather than an investment, so it must maintain a certain level of insurance compared to its investment value. This is called the "MTAR" line, and ensures that the UL policy maintains roughly the same ratio of insurance to investment as a reference 20-pay whole-life policy (the type of policy used as a reference).Before you die, the investment grows tax-deferred (as long as it continues to be considered an "exempt" insurance product.)

However, there is an "anti-dumping rule" that overrides this, and sort of short-circuits the "MTAR" rule, and allows that product's investment portion to grow by no more than 250% every 3 years – so you can put in a LOT of money, and not be limited by the MTAR line, by using the anti-dumping rule. So, if you play your cards right (and very VERY few agents who sell UL even know what MTAR and the anti-dumping rule are), you CAN avoid buying a lot of extra insurance to keep your policy tax-exempt. So, lets assume that the agent and the client know how to do this (BIG benefit of the doubt here…) So, you are avoiding the annual taxation of the growth on your investment by keeping it inside the UL policy. Just how much taxation are you avoiding on an index fund?

There are two sources of taxation on a index fund: dividends from stock of Canadian and foreign companies, and crystalised taxable gains due to the turnover of the stocks in the index (ie. one company replacing some other company on the S&P 500 or TSE-300 index, for example). These are very low – about 2.7%/year income from dividends (see globefund.com, and compare the S&P 500 or TSE-300 Composite index (no dividends) with the Total Return index (includes dividends) to confirm this figure), and perhaps 2.0%/year stock turnover. Remember, however, that its the worst performing companies that get removed from an index! This implies very low (if any) net capital gains exposure, because a crystalized capital gain one year might be offset by a capital loss the next. But lets say 0.50%/year crystalized capital gains, on average. How would these affect your net yield on a non-tax-sheltered index fund? Lets see, using a client earning between $60,000 and $100,000, and excluding the really expensive life insurance index funds from the average Canadian index fund MER to bring the average MER down to 0.4%/year:

| TYPE OF INDEX FUND: | Foreign | Canadian |

|---|---|---|

| ASSETS INVESTED: | $100,000 | $100,000 |

| GROSS RETURN @ 11%: | $11,000 | $11,000 |

| But, what about income tax? | ||

| (MER offsets against highest | ||

| taxed income from investments…) | ||

| DIVIDENDS @ 2.7%: | $2,700 | $2,700 |

| MER(avg.) @ 0.4%: | -$400 | -$400 |

| NET DIVIDEND: | $2,300 | $2,300 |

| DIVIDEND TAX @ 36% (20% cdn) | -$828 | -$460 |

| CAPITAL GAINS @ 0.5%: | $500 | $500 |

| CAPITAL GAINS TAX @ 18%: | -$90 | -$90 |

| TOTAL TAXES: | -$918 | -$550 |

| So, to summarize: | ||

| Gross Return @ 11% | $11,000 | $11,000 |

| - MER | -$400 | -$400 |

| - Taxes | -$918 | -$550 |

| Net Return == ~10% | $9,682 | $10,050 |

So, we're losing about 1.1% of the gross return by holding the a mix of 70% TSE-300 and 30% S&P 500 outside of the UL in the average index fund owned in Canada in the year 2000, weighted by assets (check out globefund.com to confirm this figure!). If straight ETFs are used instead, at an average MER of less than 0.2%, the cost would be less than 1%/year. Well, if we lose ~3% of the gross return holding it WITHIN the UL, and only ~1% holding it outside the UL, are we coming out ahead if the UL allows it to grow tax free? I think not. ~2% loss per year cuts your total return IN HALF in 36 years (72 / 2 == 36 yrs). Index funds are simply pretty tax efficient all by themselves; the UL policy doesn't have much to do, to defer taxation on your gains… but I suppose it does help reduce your taxes to lose half of your investment!?!

Your estate will be greater when you die after retirement…

By making sure your savings are within a UL policy, and are paid out as part of a tax-free death benefit. Especially compared to an RRSP.

Not true. If you buy term insurance and the identical separate investment (of course, at the far lower MER available by not bundling it with the UL) UL always loses. Period. Once again, figure it out! If someone has convinced you to sell your friends UL policies, you've been suckered, and your friends are being defrauded! Since you are going to have double the money in the plan in 36 years, you can even buy a combination of shorter 10, 15, 20 and 25 year level term insurance products appropriate for the level of initial investment, and drop it off as the net after-tax yield of your investment outstrips the death benefit of the UL!

Even if you buy term-to-100 (a variant of whole-life insurance) at a higher premium than straight term (it costs about the same outside a UL as inside), your investment will always grow faster due to the lower MERs (remember, it is the identical investment, just with about 2%/yr less waste), and after accounting for the capital gains tax, at no instant, from the first premium paid to whenever you die (be it 1 day or 100 years later), will the UL ever yield a higher death benefit than the net, after-tax yield of the identical term-100 + investment program! The shorter term + investment combination is even better! Figure it out! Note that the calculations above do not penalize the UL for the costs of insurance, premium tax, and other extra fees – because they are used to purchase just as much (or more) term insurance outside the UL as inside! Here is the same spreadsheet as referenced above, to help you compare for yourself.

Here is an example of how the UL agent will mislead the client by using an argument based on faulty assumptions. Obviously, if you compare the after-tax net benefit at death of a UL, Open and RRSP account containing the same amount of money, the UL will yield the greatest after tax benefit:

| UL | Open | RRSP | ||

|---|---|---|---|---|

| Account Value: | $1,000,000 | $1,000,000 | $1,000,000 | Incorrect assumption! |

| Principal Invested | $32,000 | $32,000 | $32,000 | |

| Taxable Capital Gain | $968,000 | |||

| Taxable as Income | $1,000,000 | |||

| Tax Payable | $188,760 | $390,000 | ||

| Net After-Tax Estate | $1,000,000 | $811,240 | $610,000 | Hence, also wrong! |

However, as discussed above, what is not disclosed is that the account value doesn't (usually) spring into existence out of nothingness; certain assumptions (such as after-tax amount invested, rate of return, deferral of taxation) exist that are not equal between each account as it grows. All you have to do is misrepresent these vital facts, and voila!, you've sold a lovely high- commission Universal Life program; and the best thing about it, the client won't know he's been shafted for several decades (if ever!); certainly, only long after you've retired to Arizona. So, to summarize (again, and again…), here's the missing assumptions (and the more correct table to compare against the results immediately above).

Remember, all three programs have the identical form and amount of life insurance, purchased with the exact same money, from the same insurance company; either within the plan (the UL program), or outside the plan (the Open and RRSP plans). These dollars are not included here, because they are identical. This analysis compares the investment portion of the 3 plans, which is paid out as a tax-free death benefit in the UL plan, and as a taxable benefit in the Open and RRSP plans. The payout at death from the insurance portion of the plan is identical in each cases, and is payable in addition to the net after-tax numbers below! Furthermore, an inflated estimate of the taxable gains paid is used for the Open account, to A) simplify the math, and B) avoid overestimating the advantages of not using the UL program. Yet, the UL program pathetically underperforms the Open and RRSP programs:

| UL | Open | RRSP | ||

|---|---|---|---|---|

| Gross Principal Invested | $32,000 | $32,000 | $48,000 | Due to RRSP refund… |

| Premium Tax | 2% | $968,000 | $0 | |

| Taxable Refund | 33% | |||

| Net Cost | $32,000 | $32,000 | $32,000 | Same net cost! |

| Net Investment | $31,360 | $32,000 | $48,000 | |

| Gross Annual Return | 10% | 10% | 10% | |

| Extra MER (over avg.) | -2.5% | |||

| "Bonusses" | .5% | |||

| Taxation of Dividends/Gains | .5% | -1% | ||

| Net Rate of Return | 8% | 9% | 10% | |

| Account Value (after 36 years) | $501,000 | $712,000 | $1,483,000 | |

| Taxable as Capital Gain (19.5%) | $680,000 | |||

| Taxable as Income (39%) | $1,483,000 | |||

| Tax Payable | $0 | $132,000 | $578,000 | |

| Net After-Tax Estate | $501,000 | $580,000 | $905,000 |

What is even more amazing is the fact that many UL projections even add the "bonus" into the projected rate of return for the UL program, to make the projection even more fancifully distorted in the favour of the UL plan! Remember the extra 2% to 3% in extra MERs are in addition to the average cost of the identical investment. In policies using index funds, it will be hidden in a complex fee formula (ie. Zurich), or by not including the dividends (ie. Challenger), or worst of all by keeping the dividends and charging a fee (ie. Perspecta). Then, by simply not disclosing this extra fee, and then adding the "bonus" back into the formula (the ultimate intellectual insult to the client!), the UL looks absolutely awesome! And the client only loses hundreds of thousands of dollars in the scam. By the way, these numbers all assume that the client is going to get full bonuses in their UL policy; the vast majority of UL holders do not receive bonuses because they do not sufficiently fund their policies; these policy holders fare much worse than shown above…

Simply put, proposals involving UL "wash loans" to fund retirement income are the most treacherous, damaging, insulting fraud being perpetrated on the Canadian population today. The combined financial damage of tens of thousands of these contracts on the retirement income generating capacity of this nation's aging population, so far as I have been able to determine, dwarfs any other fraud in living memory, in scope, hubris, and sheer intellectual malignancy. With combined losses measuring in the tens or even hundreds of billions of dollars of lost capital and income, it is destined to be the life insurance industry's Waterloo.

You can borrow from your policy, and pay yourself interest…

Instead of borrowing from a bank. Basically, you become your own bank!

I've added this one, because (in 2024), I discovered that UL agents are still selling policies by promising this strategy to their clients.

If you have to borrow money to make some purchase, it seems to make sense to borrow it from yourself, and pay "interest" back into your own account instead of borrowing from the bank, right?

In any case, you're paying the loan back with after-tax dollars, so that's the same. You can't borrow from an RRSP at all, but you can withdraw, and repay the next year without losing that contribution room.

| UL | Open | RRSP | ||

|---|---|---|---|---|

| Current Balance | $100,000 | $100,000 | $100,000 | |

| Borrowed from self | $10,000 | $10,000 | ||

| Balance start of year | $90,000 | $90,000 | $100,000 | |

| Client's Net Yield | 8% | 9% | 10% | |

| Balance (end of year) | $97,200 | $98,100 | $110,000 | |

| Repayment (at 8%) | $10,800 | $10,800 | $10,800 | to bank w/ RRSP |

| Balance (after repayment) | $108,000 | $108,900 | $110,000 |

So, all else being equal, you're better off just keeping your money in your RRSP and borrowing from the bank. But, between borrowing from the UL or the Open investment account (on margin), since the net return on the Open investment is always better than the UL, it will always win.

But, this whole charade implies that the UL, Open and RRSP investments have the same net rate of return, which we know they don't. Here's a more realistic example – one where we start off with the same investment in each product, and then borrow later.

| UL | Open | RRSP | ||

|---|---|---|---|---|

| Gross Principal Invested | $32,000 | $32,000 | $48,000 | Due to RRSP refund… |

| Premium Tax | 2% | $968,000 | $0 | |

| Taxable Refund | 33% | |||

| Net Cost | $32,000 | $32,000 | $32,000 | Same net cost! |

| Net Investment | $31,360 | $32,000 | $48,000 | |

| Net Rate of Return | 8% | 9% | 10% | |

| Balance (after 5 years) | $46,078 | $49,235 | $77,304 | |

| Borrowed or Withdrawn | $10,000 | $10,000 | $16,393 | |

| Tax | 0% | 0% | 39% | |

| Net loan after tax | $10,000 | $10,000 | $10,000 | |

| Balance (start of year) | $36,078 | $39,235 | $60,911 | |

| Client's Net Yield | 8% | 9% | 10% | |

| Balance (end of year) | $38,964 | $42,766 | $67,002 | |

| Gross Repayment (loan at 8%) | $10,800 | $10,800 | $16,200 | Due to RRSP refund… |

| Tax refund | 0% | 0% | 33% | |

| Net Repayment (at 8%) | $10,800 | $10,800 | $10,800 | Same net cost! |

| Total Balance after repayment | $49,764 | $53,566 | $83,202 |

Thus, at the time you need to borrow money (a few years after starting your UL, Open or RRSP investment program, you will always be better in anything other than the UL program.

There is no benefit to the owner for using a UL program because you can borrow from it: it will always leave the client worse-off than using the Open (borrowing on margin) or RRSP (borrowing from the bank).

In fact, you can just withdraw the money from your RRSP, pay the taxes, and then repay it in subsequent years claiming the RRSP tax refund, and be far better off than using either UL or an Open investment.

The reason: the excessive MERs of UL, and the taxation of gains in the Open investments kill the compounding of your savings, always leaving you in a worse position to borrow! After having "borrowed" $10,000 after 5 years, and repaying it in the 6th year, the RRSP still contains almost double what the UL does!

You can take the money out tax free during retirement…

By borrowing from the bank on the security of the cash value of your policy.

Awesome! This one is the easiest to kill, but the one that the UL insurance salesman uses most heavily to close the sale! Of course, if you misrepresent the entire plan, and illustrate a far greater amount of money available within the UL plan, then the UL plan will be able to generate a greater after-tax income stream. Unfortunately for the client, this will not be the case; they will be trying to generate a leveraged income stream from a far smaller pool of money than they would have in the Open or RRSP scenario. Furthermore, you can borrow money against the security of any kind of investment, tax free! Its called a margin account.

However, last time I checked, you can probably borrow a lot more against double the money outside the UL policy than you can against the smaller amount of money that's built up inside the UL! Also, the Open or RRSP accounts will sustain a far greater rate of of withdrawals, because they continue to grow at a greater rate during the withdrawal period! Furthermore, since the net after-tax yield of the Open and RRSP accounts are greater then the UL account, there will also be more left over for the estate after paying off the taxes and the margin loan. Here's an example (using the numbers from above):

| UL | Open | RRSP | ||

|---|---|---|---|---|

| Gross Principal Invested | $32,000 | $32,000 | $48,000 | |

| Net Principal Invested | $32,000 | $32,000 | $32,000 | Due to RRSP refund |

| Underlying Investment Return | 10% | 10% | 10% | |

| Client's Net Return | 8% | 9% | 10% | after extra MERs, taxes |

| Investment in 36 years (start draw) | $501,000 | $712,000 | $1,483,000 | |

| Projected in 51 years (end draw) | $1,621,000 | $2,593,000 | $1,483,000 | |

| Maximum Loan (50% leverage) | $810,000 | $1,296,000 | N/A | |

| 15 Year Income Potential (5% loan) | $37,537 | $60,060 | $148,300 | |

| Tax on Income: | 0% | 0% | 39% | |

| Net Annual 15 Year Income | $37,537 | $60,060 | $90,428 | |

| Estate, Net of Tax & Max. Loan | $811,000 | $797,605 | $905,000 | (yielding more than UL) |

| Estate, Net of Tax & Smaller Loan | $811,000 | $1,283,605 | $2,586,000 | (yielding same as UL) |

Not a big difference; only double or triple the income potential! Plus, roughly the same after-tax net death benefit, after drawing that double or triple income for a full 15 year period before death! Or, if the client opts to draw only the same reduced income as the UL plan is capable of, fabulously more net after-tax estate is left for the heirs!

Figure it out on your own financial calculator, UL salesman (if you're able)! Remember, this is the investment portion of the total plan only; you have the same amount of the same type of insurance (say, a million of T-100), being purchased with the same number of dollars, in both the UL and the BTID plans, so the insurance is added to these at death! Remember, for borrowing or "wash loan" purposes; only the investment portion of the UL plan is considered by the lending institution; the bank doesn't lend money against the "face amount" of the UL plan. Also note that we are not even using leverage to draw income from the RRSP, although you can, and this would make the comparison even more ridiculous!

Not only can you borrow more tax-free against the identical investment outside the UL plan, it continues to compound faster! Even if you put more money into the UL policy to catch it up and break even with the non-UL investment, since the UL has extra MERs, you won't be able to generate as high a borrowed income stream from the UL, because it won't "regenerate" (increase the investment account compared to the loan) as fast as the non-UL investment!!! Look, figure it out for yourself ! If anyone shows you a "projection" based on borrowing money out of your UL to fund your retirement, ask them to show you the exact same investment compounded outside a UL policy (of course, make sure they don't apply the UL's excessive up-front and annual extra MER fees!), followed by borrowing money tax free on margin. They won't – either because they can't ("Hey, my UL insurance company supplied program doesn't do that!" (big surprise)), or because they don't want to ("Oops… Hey, this seems to show that my UL program sucks!").

This "wash loan'' fiasco is the greatest misrepresentation being made today by UL salesmen today: that UL is the "ultimate retirement tax shelter", or the "last permanent Canadian tax shelter'', or "how to get trapped cash out of your business''. Not only are they misrepresenting that UL is the best or only way to draw income tax-free from a compounding investment, they are damaging their clients ability to do precisely that, by trapping them in terrible investments with grotesquely bloated MERs, so they won't be able to generate the maximum income stream when they do retire! It's terrible – once someone does figure this scam out, the penalties are quite huge in the early years (surrender charges), or the tax consequences quite large in the later years! Unfortunately, the cost of actually keeping the policy is even worse, so the client is forced to wind up the policy regardless of the cost ("Gee, pay 19.5% tax now on the capital gain, or lose 50% of my investment later…")

This strategy only needs one more strategy to be truly complete; a way to "get trapped cash out of your Whole-Life insurance agent"!

Your insurance is less expensive over your lifetime…

If you pay for it from inside a UL policy, because eventually you are paying with it with mostly before-tax dollars.

I won't even validate this one with an argument. It is (also) so stupid that it is almost breath-taking. Once again, do the math, calculating the net after-tax yield of the investment outside the UL. In not too many years, the net after-tax yield of the investment alone outstrips both the insurance and the tax-free investment components of the UL policy, combined! But, it is a great way to get people to buy your whole-life insurance, if you're a "whole-lifer"…

Remember, the purpose of a plan involving life insurance is to leave a certain level of net after-tax estate. If you can take the same dollars and leave a greater estate, using the exact same investment and rate of return assumptions, perhaps not even employing a life insurance product in the plan after a certain point, what rational client would choose the plan yielding the lower estate value? Probably not the 70% of clients who last year purchased some variant of whole-life insurance. Could the systematic misrepresentation of fact in hundreds of thousands of client policy projections, spanning over several decades, have had anything to do with it? Naaah, probably not…

Conclusion

Any way you slice it, UL is brutal for the owner, and awesome for the salesman – it will generate a far greater commission than selling the straight term insurance with a separate investment. It is great to sell to anyone not interested in figuring out the math, by any salesman not interested in whether or not his/her clients are being shafted. The proofs against it are independent of rate-of-return assumptions, are are easily grasped by even mathematically disinclined clients and agents. Therefore, there is no excuse for the apparent lack of action against these abuses by the regulatory agencies responsible for protecting the interests of life insurance clients.

Worst yet, there are droves of young agents being misled into selling these contracts to their friends and family, by whole-life insurance agency owners slavering over the fat overrides and agency commissions generated by all these Universal Life insurance sales within their agency. Do you really think that most new, young agents understand these facts about how UL works? Not likely. Do you think that an agency owner understands them? Of course – they are not stupid! They can do the same basic arithmetic that I can!

Dear whole-life insurance agents;

If anyone would like to comment on the math presented above, please call or email! I have the same copies of many of the contracts of UL being sold today that you do, and I'll gladly correct any math problems or logic flaws in this document! There are 5 significant variants of UL designs/scams currently being sold, that I'm personally familiar with – the ones above are just how a few types of policies handle the client's money. I'd love to discuss any/all of them with you! But please don't waste your time or mine if you really have no intention of acting responsibly on what you might discover. Most people who sell most things, it would appear, will continue to sell them regardless of whether they discover shortcomings or problems with the product, even if these shortcomings damage their own clients! If you are like that, then please don't bother to investigate – at least you'll be able to continue sleeping soundly at night! Furthermore, if you want to say something inane that begins with "Well, I just believe that…" or "Well, my manager told me that…", or "It's impossible for so many very smart insurance salesmen, accountants, etc. to be wrong!" then please don't call or write; but do yourself a favor – get out of the financial industry, stop screwing your clients financial lives up, and go do something that doesn't require integrity or independent thought.

Disclaimer

This document is Copyright (c) 2001 by Perry Kundert, and is solely My Personal Opinion. In no way does this document reflect the opinion of any other person or organisation, including (but not limited to) Primerica Financial Services or Citigroup. Nor is any ill will intended toward Transamerica, Zurich, Standard, or any other Whole-Life insurance company; they just happened to be the UL policies closest at hand (Lucky them! Free advertising…) As stated, Canada is a free country, and anyone is free to sell any product they wish, so long as they are telling the truth to their clients. Please take responsibility for your own actions. I will take responsibility for my own opinions. And remember, boys and girls; It's Just Math!